Portfolio diversification is crucial for protecting yourself from market volatility. Nowadays, investing in mutual funds is becoming an attractive investment choice for many! Among the various types of mutual funds, theme-based investing and sector mutual funds exist. These strategies offer distinct approaches to diversifying your investment portfolio. Thematic funds focus on specific trends, while sector funds target entire industries. In this article, we will discuss what exactly thematic funds vs sector funds are and what the tax in thematic funds and sector funds is.

What are Sectoral Funds?

Sectoral funds are a form of equity mutual fund that focuses its investments on a particular sector or industry. They focus on investing in companies within a specific sector of the economy, such as healthcare, finance, utilities, agriculture, technology, etc.

Sector mutual funds aim to take advantage of the performance of a particular sector. However, this focus means they can be riskier because they are vulnerable to sector-specific trends and events.

Who Should Invest in Sectoral Funds?

- Risk Takers

Sectoral funds focus on specific sectors, which means they have less diversification and can be quite risky. These funds are best suited for investors who are comfortable with taking on higher risks.

Now, invest in mutual funds, stocks, bonds and more, all with a free demat account and zero AMC!

- Active Investors

If you’re new to investing, sectoral funds might not be the best choice right away. Investing in these funds requires a deep understanding of the sector.

- Investors Looking for Strategic Opportunities

Are You Ready to Invest in Cyclical Sectors?

Some sectors, like the auto industry, go through cycles of highs and lows. For investors with a high-risk tolerance, there’s potential to profit. You can do that by investing in a sector when it’s at a low point and waiting for it to peak. It takes skill and patience to time your investments.

What are Thematic Funds?

Thematic mutual fund investments involve a specific theme or trend. Now, it could be renewable energy, digital innovation, or infrastructure. Unlike sectoral funds, thematic funds can include companies from various sectors that fit the chosen theme. This approach offers broader diversification compared to sectoral funds. However, it can also involve higher risk due to the focus on a particular theme.

So, as mentioned, thematic funds are a type of mutual fund.

But what sets thematic funds apart from regular mutual funds?

Let us see!

Thematic Funds vs. Mutual Funds

Theme based funds invest in companies that are tied to a specific theme or trend. So, if you believe a particular theme will do well, thematic funds might be the way to go.

The potential returns can be high if the theme performs well, but there’s a higher risk due to their concentrated investment approach.

Mutual Funds can be categorised into equity, debt, hybrid, and more. They invest based on various factors like market capitalisation, investment style, or sector.

- Mutual funds typically provide more diversification across various sectors and asset classes.

- The risk and return can vary widely depending on the type of mutual fund. Equity funds usually offer higher returns but come with more risk, while debt funds are generally more stable with lower returns.

Thematic funds tend to be riskier because of their concentrated focus. Mutual funds, on the other hand, can offer a more balanced risk profile depending on the type.

Who Should Invest in Thematic Funds?

- Investors with a Strong Belief in Emerging Trends

If you’re confident about the future of a particular trend, theme based investing can be a good choice. They allow you to invest in companies aligned with these themes.

- Research-Driven Investors

Thematic funds often require thorough research and a good understanding of the chosen theme. Experienced investors who can analyse trends will find these funds more suitable.

- Investors Looking for Diversification Across Sectors

When we talk about the difference between thematic and sector funds, unlike sector funds, thematic funds include companies from various sectors that fit the theme. This broader diversification can help spread risk.

Investing in thematic funds often requires a long-term perspective. If you’re patient and willing to wait for the theme to fully develop, these funds can offer significant growth potential.

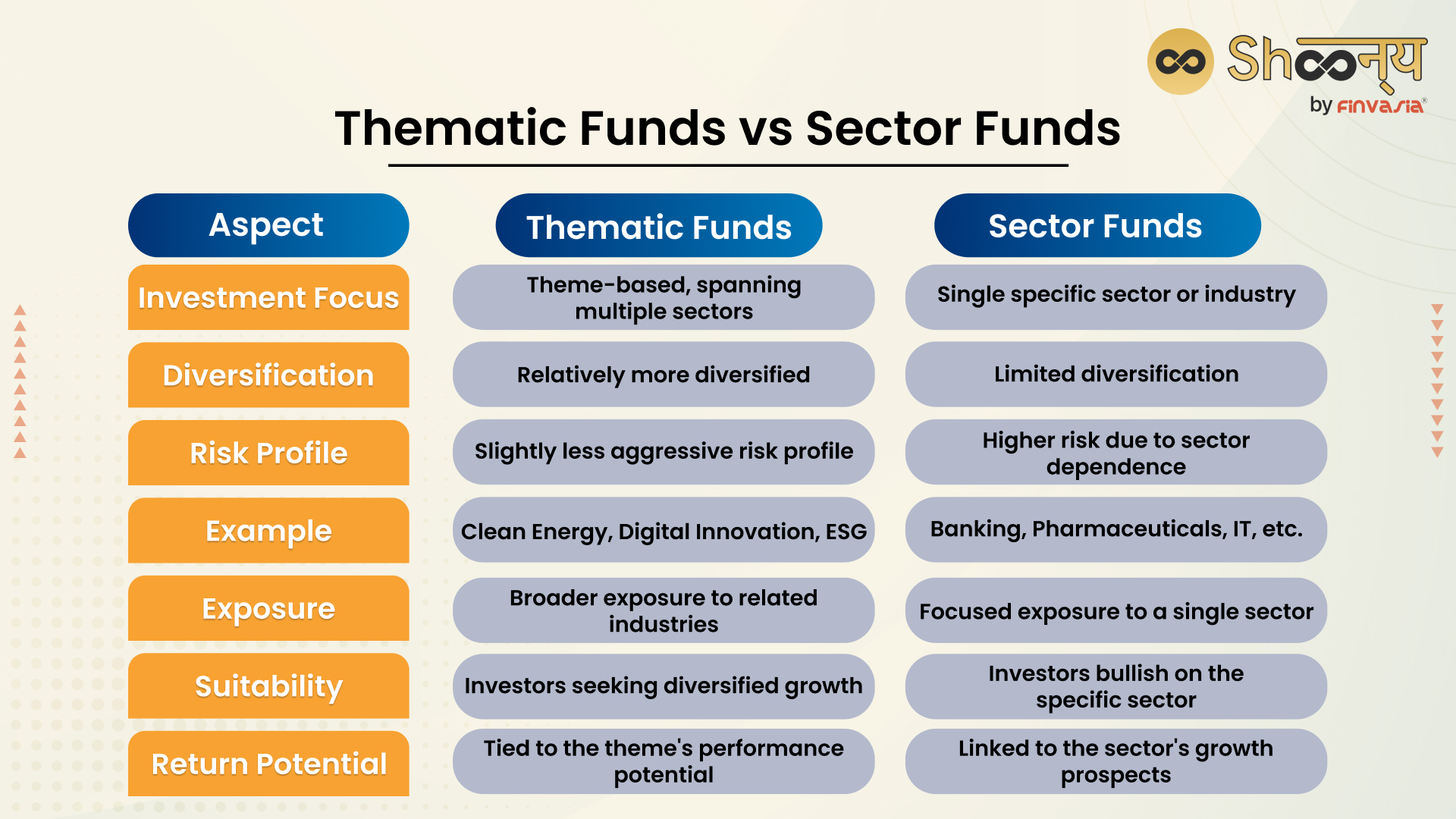

Thematic Funds vs Sector Funds: What to Know

Let us understand the clear difference between thematic and sector funds.

| Basis | Thematic Funds | Sector Funds |

| Investment Focus | Theme-based, spanning multiple sectors | Single specific sector or industry |

| Diversification | Relatively more diversified | Limited diversification |

| Risk Profile | Less risky compared to sector funds | Higher risk due to sector dependence |

| Example | Clean Energy, Digital Innovation, ESG | Banking, Pharmaceuticals, IT, etc. |

| Exposure | Broader exposure to related industries | Focused exposure to a single sector |

| Suitability | Good for those wanting broad growth | Good for those confident in one sector |

| Return Potential | Depends on how well the theme does | Depends on how well the sector performs |

Key Difference Between Thematic and Sector Funds

Wondering about the basics of thematic funds vs sector funds?

Let’s break down which one might be a better fit for your investment strategy.

Sector Funds:

- These mutual funds invest in companies within a specific sector of the economy.

- If you think the pharmaceutical industry will do well, you might invest in a pharmaceutical sector fund. This fund will include stocks from companies like Cipla, Dr Reddy’s, and Sun Pharma.

Read about Sun Pharma- India’s largest pharma company by marketcap!

Thematic Funds

- These invest in companies across different sectors that align with a specific theme.

- If you believe in the future of clean energy, you might choose a thematic fund focused on renewable energy. This fund could include stocks from various sectors, like solar power, wind energy, and electric vehicles. It will be focused on companies such as Tata Power, Suzlon Energy, etc.

Sectoral Funds: Concentrate on a single sector.

Thematic Funds: Spread across multiple sectors related to a common theme.

Taxation of Sectoral and Thematic Funds

Sectoral funds, like thematic funds, are treated as equity-oriented funds for taxation purposes.

- Tax in Thematic Funds

- Tax in Sector Funds

Both thematic and sector funds are treated as equity-oriented funds for tax purposes, so their tax treatment is quite similar.

Thematic Funds vs. Sector Funds| Advantages and Disadvantages

Theme-based investing offers the advantage of diversification. This approach helps to spread risk compared to sector funds. However, thematic funds come with their own set of challenges. Their performance heavily depends on the success of the chosen theme.

If the theme loses momentum, returns may be adversely affected.

On the other hand, sector funds provide focused exposure to a single sector, which can be advantageous if that sector experiences strong growth. This targeted investment approach can lead to high returns if the sector performs well. Despite these potential benefits, sector funds carry higher risks due to their concentrated exposure.

If the sector faces downturns, the impact on the fund can be significant. Moreover, sector funds can be influenced by short-term market dynamics.

Conclusion

It is important to understand the difference between thematic and sector funds. Thematic funds offer the benefit of diversification by investing across multiple sectors linked to a broad trend. However, their success relies on the strength of that theme. On the other hand, sector funds provide concentrated exposure to a specific sector, which can lead to substantial returns if that sector performs well.

Ultimately, the choice depends on whether you prefer a diversified, trend-based investment or a targeted, sector-specific approach.

FAQs| Thematic Funds vs Sector Funds

Theme-based funds are invested in a variety of sectors tied to a broad theme. It could be renewable energy, digital innovation, etc. In contrast, sector funds focus solely on companies within a single sector, like fintech, pharma or healthcare.

Thematic funds can offer high returns if the chosen theme performs well. However, they come with higher risks and require thorough research.

Sector investing focuses on one specific industry. Thematic investing, on the other hand, focuses on upcoming trends that affect multiple industries, for e.g. fintech.

Sectoral funds can be riskier due to their narrow focus, which makes them more susceptible to sector-specific downturns and volatility.

Short-term gains in both thematic and sector funds are taxed at a rate of 15% plus surcharge and cess.

Source: TheEconomicTimes

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.