Have you ever wondered why some stocks open much higher or lower than their previous closing prices? Is there a way to take advantage of these sudden price jumps? Yes, you can benefit from these price gaps. The key is using the gap up and gap down strategy!

This strategy is simple yet powerful. It helps you make the most of the price gaps that happen when the stock market opens.

Gap up and gap down are important in the stock market. They can show short-term momentum and trading opportunities. You must know how to predict gap up and down to make daily trading decisions.

However, what exactly are gap up and gap down?

Let us see!

What is Gap Up

A “gap up” occurs when the opening price of a stock or index is higher than the closing price of the previous trading session. This upward movement creates a visible gap on the price chart between the previous day’s closing price and the current day’s opening price.

Gap-ups often indicate positive market sentiment. This positive trend can be triggered by multiple factors, such as:

- Positive news

- Strong earnings reports

- Other favorable developments related to the company or the Indian stock market as a whole.

Let us say that you own shares of “ABC Electronics.”

One evening, after the market closes, ABC Electronics announces a groundbreaking invention that everyone has been waiting for.

The next morning, when the market opens, the gap up opening stocks of ABC Electronics is higher than where it closed the previous day.

This is a “Gap Up.”

Investors are excited about the news, and many want to buy the stock right away, causing a jump in price.

What is Gap Down

A “gap down” happens when the opening price of a stock or index is lower than the closing price of the previous trading session. This downward movement creates a gap in the price chart. This indicates a sudden drop in price from the previous day’s closing level to the current day’s opening level.

Multiple factors can cause a gap down, such as:

- Negative news

- Poor company earnings reports

- Political tensions

- Geopolitical events

- Other unfavourable factors impacting the market or specific stocks of the company.

Now, let’s consider “XYZ Pharma.”

After the market closed, news broke that one of XYZ Pharma’s key medications didn’t pass a crucial safety test conducted by the government.

Now what?

This is certainly negative news that will impact the company and the investor’s interest.

When the market opens the next day, the price of XYZ Pharma is much lower than the closing price from the previous day.

This is a “Gap Down.”

Investors, worried about the failure report, might be selling off their shares, leading to a drop in price.

Factors Causing Gap Up and Gap Down

Here are some simple reasons why gaps in stock prices can happen:

1. News Releases

News can have a strong effect on stock prices, often causing a gap up or gap down in trading.

Big news about a company, like earnings reports or new product launches can cause sudden changes in stock prices.

- If a company does better than expected, its stock might jump up. If it does worse, the stock may drop.

- Events like elections or conflicts can create uncertainty, leading to gaps.

- News about jobs, inflation, or economic growth can affect stock prices and cause gaps.

2. Analyst Views

When financial analysts change their opinions about a stock, it can impact the price.

Let us say that if an analyst upgrades a stock from “hold” to “buy,” more people might want to buy it, causing the price to rise.

3. Trading Pressures

Large buy or sell orders can create gaps.

For instance, if many investors suddenly decide to buy a stock, the price can gap up due to high demand.

4. Market Sentiment

Market sentiment is how investors feel about the market or a specific stock. This can influence gaps significantly.

- Bullish Sentiment: If investors are feeling good, good news can lead to price jumps (gap ups).

- Bearish Sentiment: If investors are worried, bad news can cause price drops (gap downs).

- Psychological Factors: Emotions like fear or greed can amplify reactions to news, causing bigger gaps.

Types of Gaps in Trading

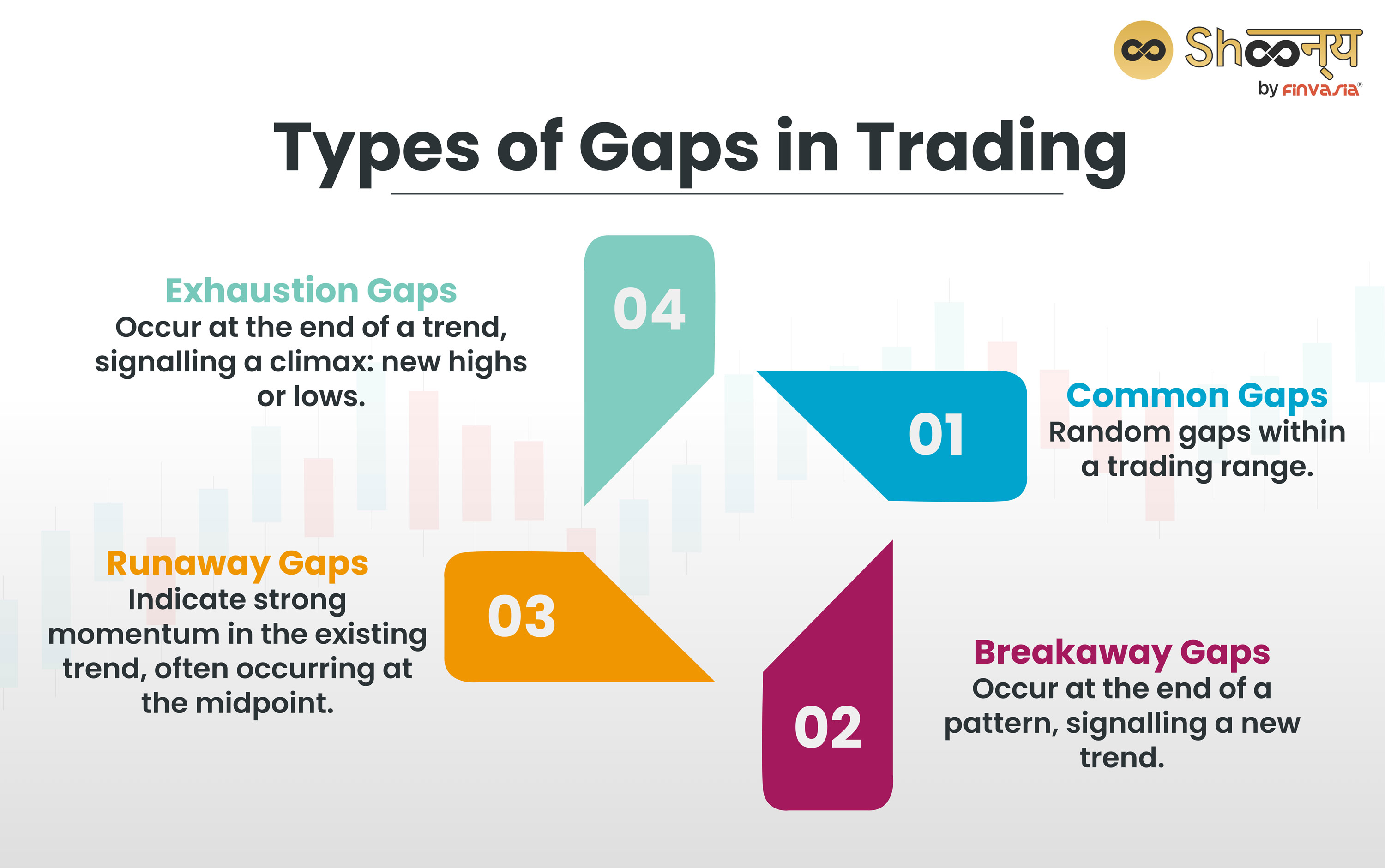

There are four main types of gaps:

Common gaps, breakaway gaps, runaway gaps, and exhaustion gaps.

Each type of gap has a different implication for the trend and the trading strategy.

Common Gaps

These are usually uneventful and occur randomly within a trading range. They are often filled quickly and do not indicate any significant change in the trend.

Breakaway Gaps

These occur at the end of a price pattern, such as a consolidation, a triangle, or a channel, and signal the start of a new trend or a breakout from the previous range.

They are usually accompanied by high volume and are not likely to be filled soon.

Runaway Gaps

They occur in the direction of the existing trend and indicate a strong momentum and continuation. Also called measuring gaps, they often occur at the midpoint of a price movement.

Exhaustion Gaps

These occur at the end of a price movement and indicate a final push or a climax of the trend. A reversal or a correction often follows them, as the buyers or sellers lose steam and the other side takes over. They are usually filled quickly and mark the end of the trend.

Nifty Gap Up Gap Down Strategy

Here are some strategies for trading Nifty when there are gap ups or gap downs:

Gap Up Strategy

- Identify the Gap: Look for a gap up of more than 50-60 points in Nifty.

- First 15-Minute Candle: Observe the first 15-minute candle after the market opens.

- Entry Point: If the first 15-minute candle is bullish, you can buy if the price breaks above the high of this candle.

- Stop Loss: Do not forget to place a stop loss at the low of the first 15-minute candle.

- Exit Strategy: You must set a target based on your risk-reward ratio or exit if the price falls below the stop loss.

Gap Down Strategy

- Identify the Gap: Look for a gap down of more than 50-60 points in Nifty.

- First 15-Minute Candle: Observe the first 15-minute candle after the market opens.

- Entry Point: If the first 15-minute candle is bearish, you can sell if the price breaks below the low of this candle.

- Stop Loss: You can place a stop loss at the high of the first 15-minute candle.

- Exit Strategy: Set a target based on your risk-reward ratio or exit if the price rises above the stop loss.

Note: This information isn’t financial advice and might not be accurate for every situation. You must always do your own research and consider talking to a financial advisor.

How to Predict Gap Up and Gap Down

Gaps are key indicators in the stock market. They show the direction, strength, and duration of trends.

Predicting gaps is tough. This is because any unexpected news can change market sentiment. Most of the traders use premarket scanners to spot gap up opening stocks. These tools look at volume and price changes before the market opens.

If you want to predict gap up and gap down, technical indicators can help, too.

Fundamental analysis is also useful. It looks at a security’s intrinsic value based on financial performance, growth prospects, and external factors. This gives insights into why gaps happen.

For gap-up and gap-down strategies, you can identify the gap type, direction, and significance.

To manage risks in trading, use techniques like stop-loss orders, position sizing, and portfolio diversification.

Note- It’s important to know that predicting gaps isn’t always possible. Markets are influenced by many unpredictable factors. You must always be prepared for unexpected changes..

Must Know Things about Gap Up and Gap Down Strategy for Traders

Here are a few key points that you must know about gapping:

- Volatility

Gap up and gap down strategy often causes increased volatility in the market.

You must stay\ active during the opening minutes of a trading session.

- Gap Filling

Gap filling refers to when a stock’s price returns to the level it was at before the gap.

- Partial Gap Fill: Sometimes, the price might only return halfway to its previous level before continuing its trend.

- Full Gap Fill: Other times, the price completely returns to the pre-gap level.

- Technical Analysis Indicators

Technical indicators can help traders understand or predict gaps in stock prices.

Here are some of the tools that you can use:

- Moving Averages: These show the overall trend and possible support or resistance points.

- Relative Strength Index (RSI): This helps identify if a stock is overbought or oversold. You can easily understand the upcoming gaps.

- MACD (Moving Average Convergence Divergence): This shows changes in momentum that might lead to gaps.

- Gap Trading Strategies

Traders use different strategies to take advantage of gaps in stock prices.

Here are a couple of popular methods:

- Gap and Go Strategy: Trader may buy in the direction of the gap, hoping the trend continues.

For example, if a stock jumps up due to good news, they might buy it expecting more gains.

- Fade Strategy: Traders bet against the gap, expecting the price to fall back.

If a stock jumps up too much too quickly, they might sell it quickly.

- Confirmation

It’s essential to wait for confirmation of a gap movement before making trading decisions. You must know that not all gaps lead to sustained trends. Some may be quickly filled as the market adjusts.

- Risk Management in Gap Trading

As with any trading strategy, risk management is a crucial part of the gap-up and gap-down strategy, too!

Setting stop-loss orders and having a clear understanding of potential losses is important when dealing with gap movements.

- Pay attention to the volume.

Usually, breakaway gaps should have a high volume. On the flipside, exhaustion gaps should have a low volume.

Learn to trade gaps in the stock market.

Conclusion

Understanding gap-up and gap-down movements in trading is important. By combining technical and fundamental analysis, you can better predict these price gaps.

However, you must always be prepared for unexpected changes and remember that proper risk management is crucial when trading gaps.

FAQs| Gap Up and Gap Down

A gap up happens when a stock opens higher than it closed the day before. A gap down is when the stock opens lower than the previous close.

A market gap-down means the market or securities open lower than the previous day’s close, reflecting bearish sentiment.

A gap-up is generally considered bullish, signalling buyer eagerness and a potential uptrend. However, traders need additional analysis to confirm its significance. Gaps can be misleading or quickly filled.

The Indian market opens gap up or gap down due to overnight news, earnings reports, or global market trends.

Gap ups and gap downs happen when there is a strong shift in demand or supply due to news, earnings, or other events.

You can predict a stock might gap up by looking at positive news, strong earnings reports, or high pre-market trading volumes.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.