Are you planning to enter the field of stock market trading? But do you feel confused by the different types of demat accounts and the documents required? In this post, we will explore what a demat account is, why you need one, and how to open demat account for beginners in India in a few easy steps.

Let’s get started!

- What is Demat Account and How Does it Work?

- Why Do You Need to Open Demat Account?

- Opening Demat Account: Understanding Associated Charges

- How to Open Demat Account on Shoonya?

- How to Open Various Types of Demat Accounts Offline: Steps and Instructions

- How to Open Demat Account in India| Know the Documents Required

- How to Open Demat Account in India| Things to Remember

- Choosing the Right Depository Participant| Why is it Important?

- Protect Your Demat Account in the Digital Age

- FAQs| How to Open Demat Account| Shoonya

What is Demat Account and How Does it Work?

A demat account lets you store and handle various securities, such as stocks, mutual funds, bonds, etc., in a digital format. It eliminates the necessity for physical certificates and paperwork.

It replaced the old-fashioned way of holding physical share certificates, making trading faster and safer.

An online demat account makes the trading and investing process easier, faster, and safer.

The concept of Demat accounts in India began in 1996. The purpose of a demat account is to solve the problems associated with physical securities, such as the risk of loss, theft, and forgery.

Online demat accounts have transformed the Indian stock market by making transactions quicker and improving overall trading efficiency.

You can hold multiple securities in a Demat account, including:

- Equity: Shares or stocks of companies.

- Bonds and Debentures: Debt instruments issued by corporations and governments.

- Exchange-Traded Funds (ETFs): Funds traded on stock exchanges, offering diversification and flexibility by holding stocks, bonds, etc.

- Government Bonds: Debt securities issued by the government to fund spending.

- Mutual Funds: Investment programs funded by shareholders that trade in diversified holdings.

Demat account offers a smooth and modern way to invest in different financial instruments.

Before we step in to understand how to open demat account, you must know the benefits.

Why Do You Need to Open Demat Account?

A demat account is compulsory for anyone who wants to trade or invest in the Indian stock market.

You need to open demat account because it offers many benefits and advantages, such as:

- An online demat account enables you to access your securities from anywhere and anytime with a user ID and password.

- It decreases the risk of loss, theft, damage, or forgery of physical certificates.

- It facilitates the automatic transfer of dividends, interest, refunds, etc., to your linked bank account.

- With a Demat account, you can easily track your investment portfolio and monitor changes in the value of your holdings.

Opening Demat Account: Understanding Associated Charges

Here are various charges related to the demat accounts in India:

- Demat Account Opening Charges: When you open Demat account, you’ll have to pay certain fees.

These usually range from ₹200 to ₹3001.

Shoonya offers a free demat account.

- Trading Account Opening Charges: In addition to the Demat account, you’ll also need a trading account to make trades.

Some of the brokers charge a fee for opening an online trading account.

3. Annual Maintenance Charges (AMC): AMC is an annual fee you pay to maintain your Demat account. It covers administrative expenses and ensures your account runs smoothly.

4. Brokerage Fees: Your broker charges brokerage fees for executing trades on your behalf.

It can be a fixed amount per trade or a percentage of the transaction value.

With Shoonya, you can enjoy:

- A free demat account with zero AMC

- Trading in all the market segments across all the major stock exchanges in India.

- Zero brokerage trading on mutual funds, IPOs, ETFs (delivery trades), etc.

- Free demat and trading account

How to Open Demat Account on Shoonya?

To open demat account on Shoonya, you can either download the Shoonya app from the Play Store/Apple Store or you can directly visit- PRISM.

Here are a few steps to open demat account on this online trading platform:

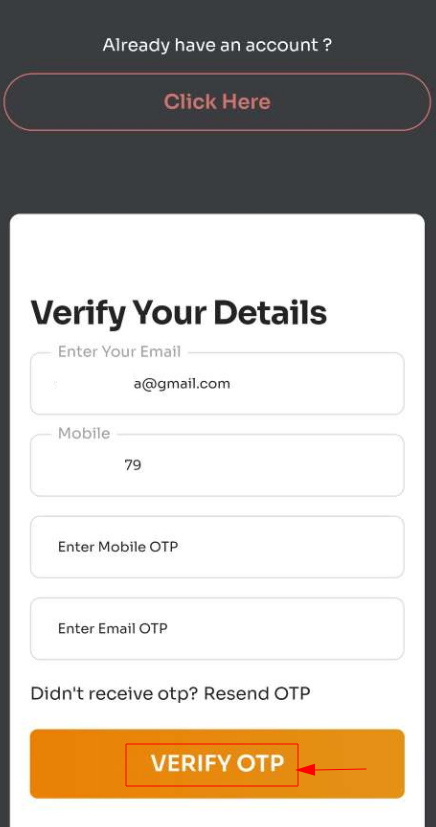

- Enter Details and Verify OTP: You must click on “Register Now.”

Next, please provide your email and mobile number. You will get verification codes on both. You must enter those codes to verify your account.

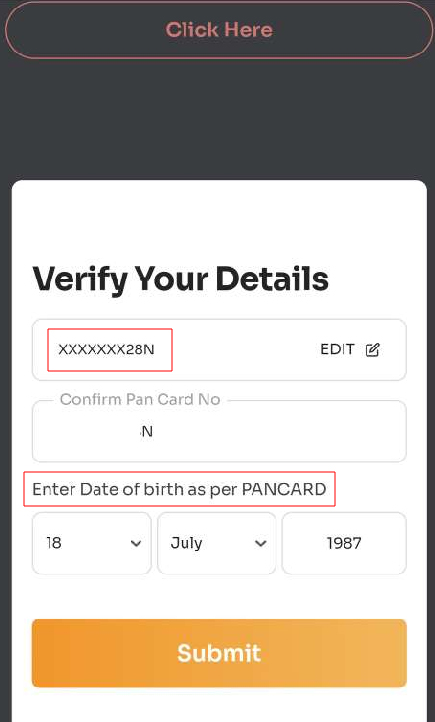

- Provide PAN and Date of Birth: Enter the PAN card number and your DOB- date of birth as they appear on the PAN card.

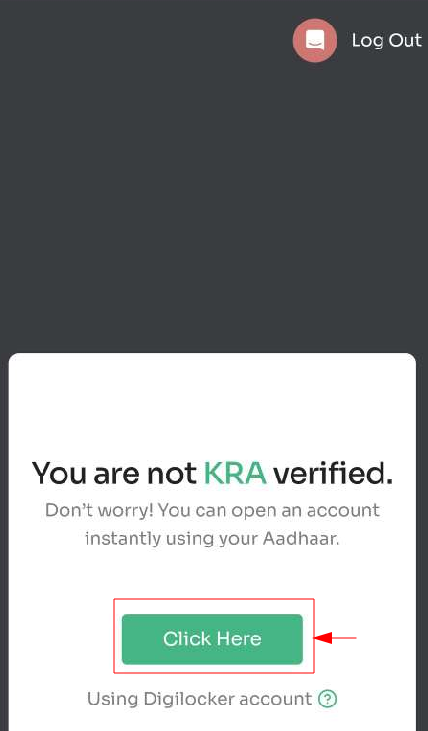

Additional Steps for Non-KRA Users Only- If you haven’t done your KRA KYC Validation, click here ↓

You will receive a notification stating, ‘you are not KRA verified.’

KRA, or KYC Registration Agency, stores and verifies investor KYC details in the securities market. To check your KRA verification status, enter your PAN number on any one of the KRA websites, such as CVL, DotEx, Karvy, NDML, or CAMS.

If verified, your status will show as ‘Verified’; otherwise, it will be ‘Not Available’ or ‘Pending’.

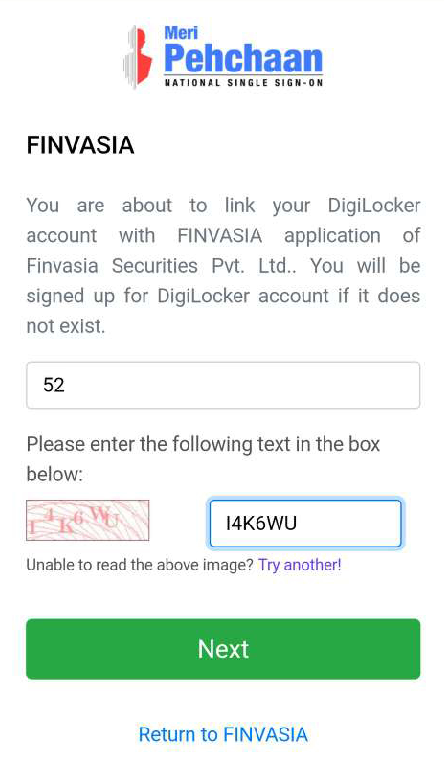

Next, you need to enter your Aadhar number and CAPTCHA.

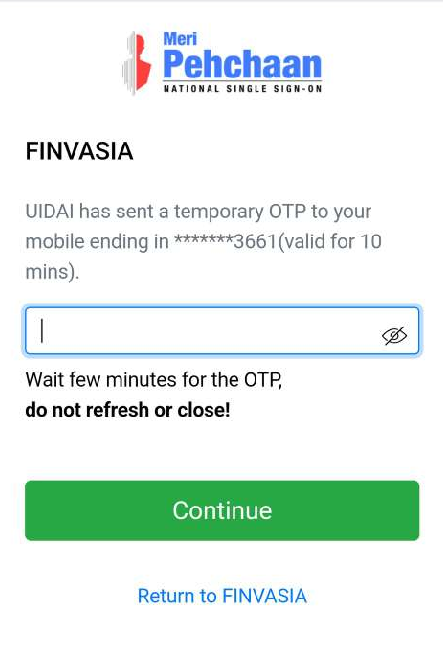

- Once you enter that, you will receive the OTP.

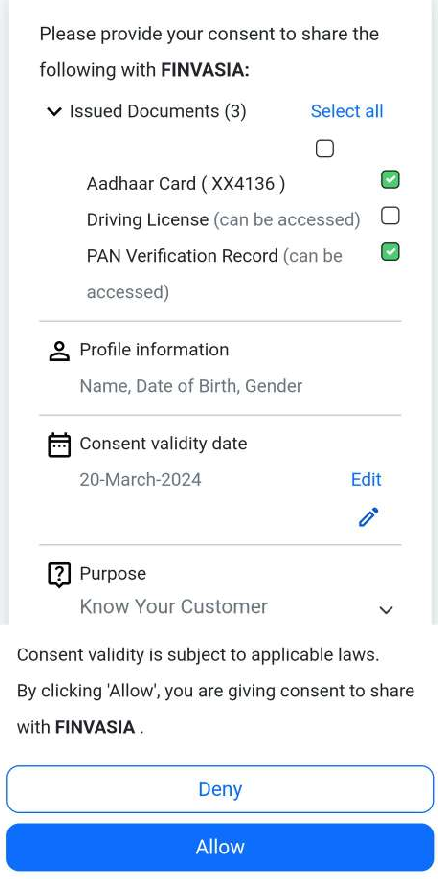

- Next, you need to give consent by clicking on ‘Allow’ to access your digilocker details, which are automatically fetched from your account.

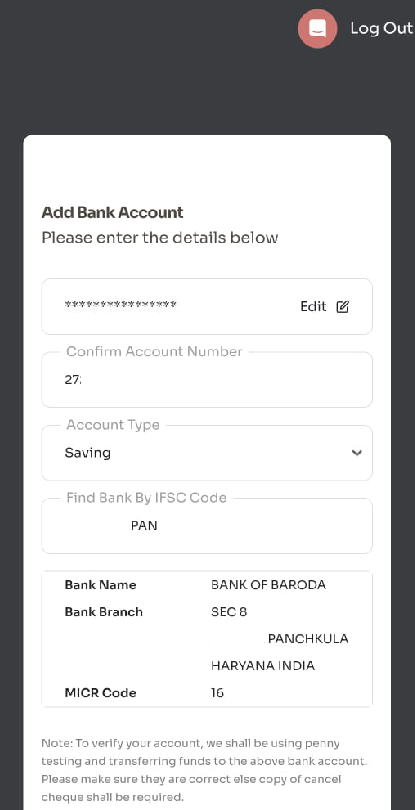

3. Enter Your Bank Account Details: Next, you must enter your account number, IFSC code, and branch details.

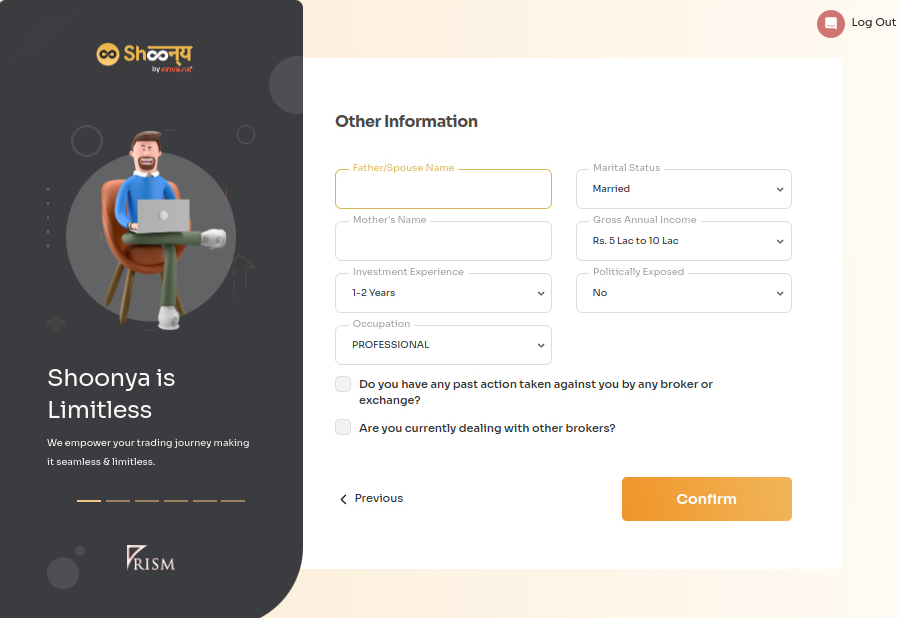

4. Enter Personal Details: Enter all your relevant details as per the image below.

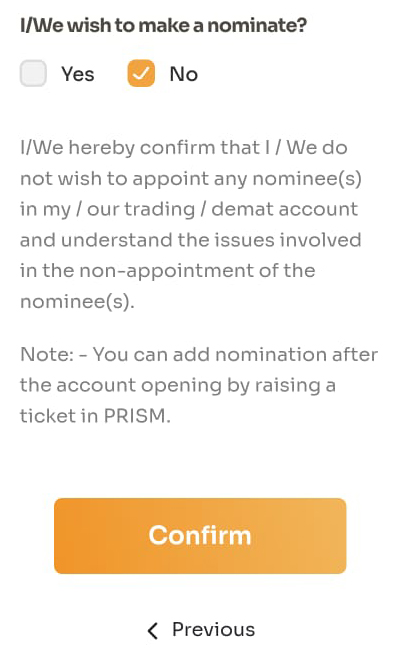

- Adding a nominee option

For instance, for adding the nominee, it shall by default be set as ‘No’.

You can also add your nominee later by raising a ticket on the PRISM portal.

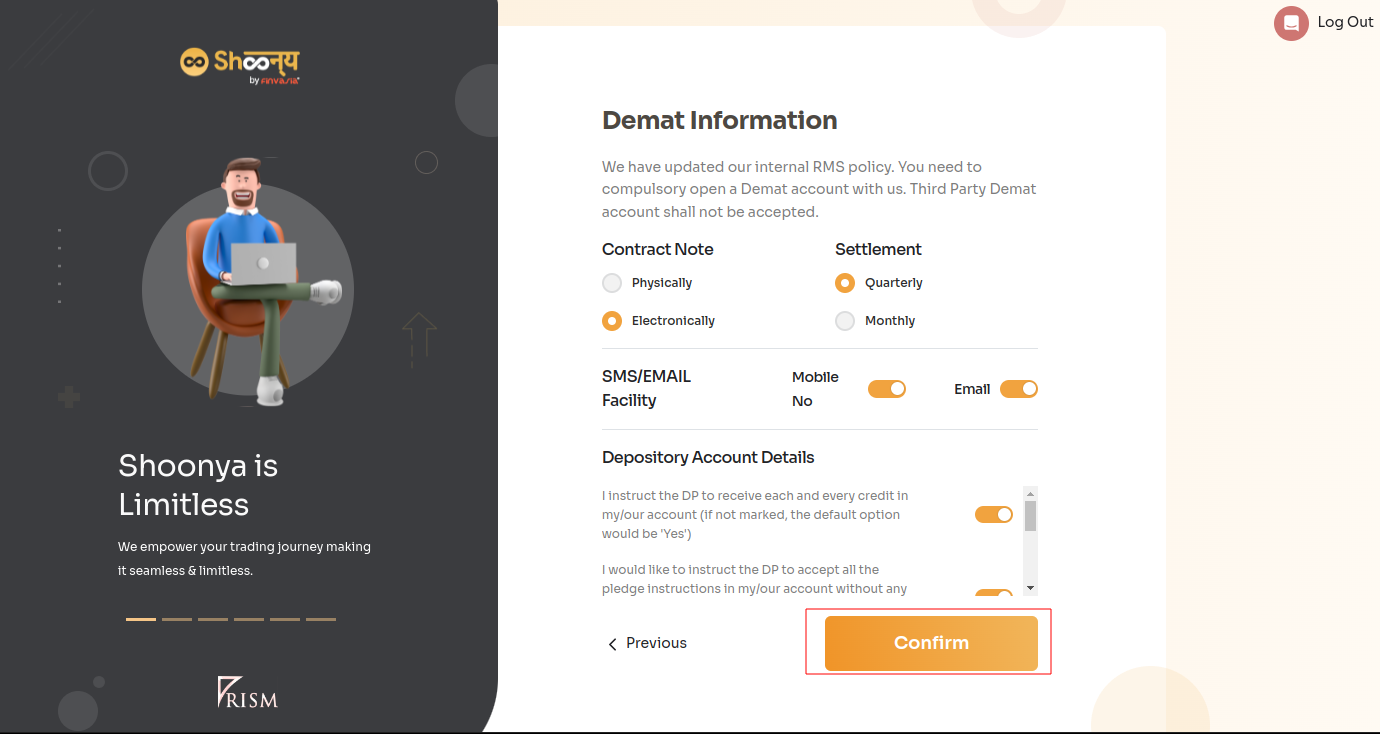

- You need to cross-check the demat account information as shown in the image below and click on ‘confirm.’

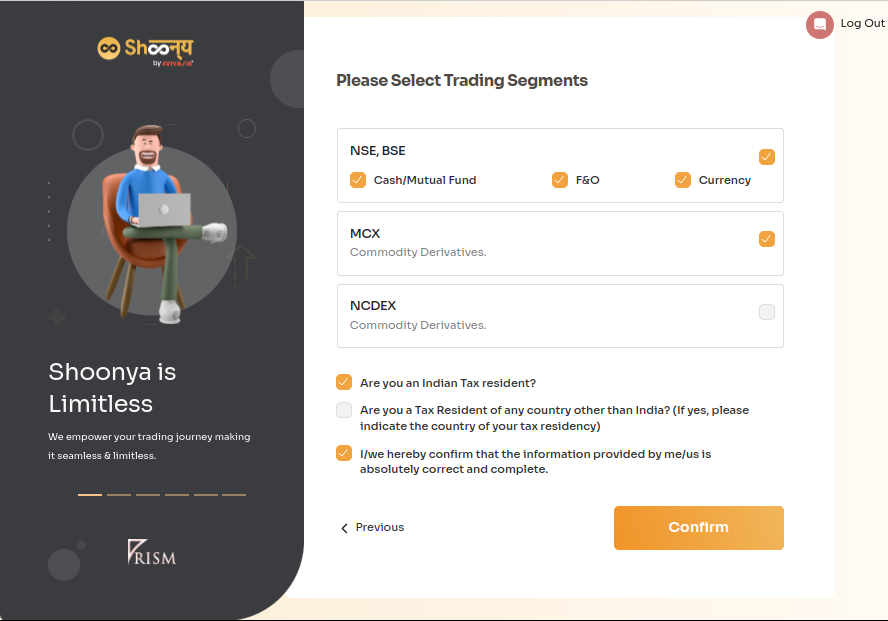

5. Confirm Details and Select Your Trading Segments: You can select your trading segments like NSE, BSE, MCX, and NCDEX and click on ‘confirm.’

Note– For FATCA Instructions, click on the second option only if you are an NRI.

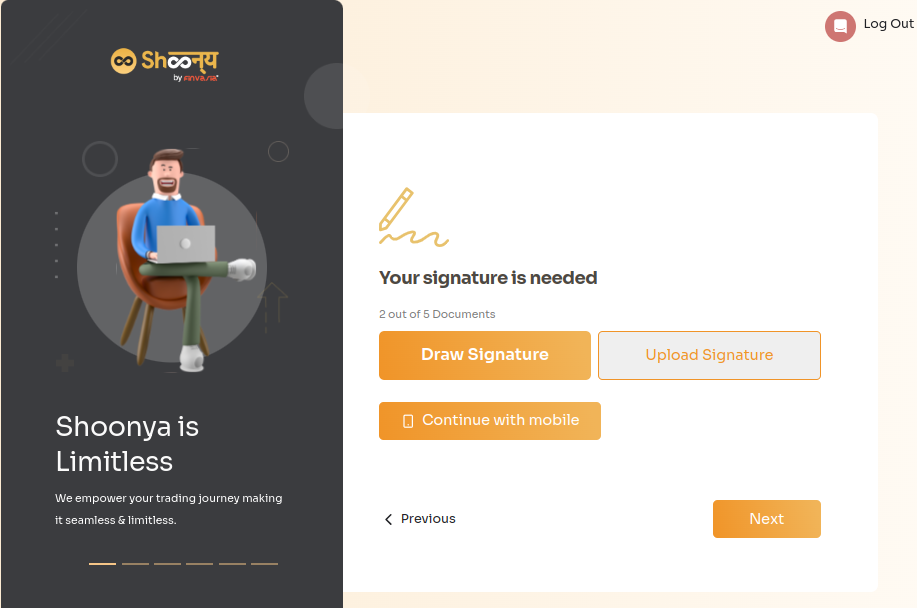

6. Upload Latest Signature: You can draw your signature on the screen, or you can upload a picture of your signature on plain paper.

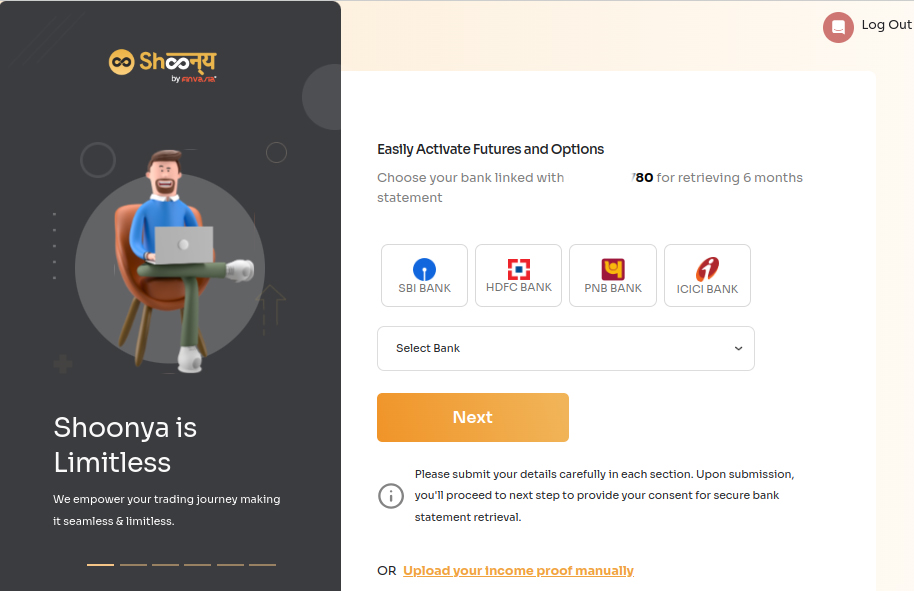

7. Complete Additional Steps: You must provide income proof depending on your chosen segment.

Please note that your income proof is mandatory for the FnO segment.

Note- We are now utilising an account aggregator where you will need to select your bank and enter the OTP. Your latest six-months bank statement will be automatically fetched with just one OTP.

Alternatively, you can choose the manual upload option for documents.

You can upload any one of these:

- Latest 6 Months Bank Statement

- Latest ITR

- Latest Form 16

- Latest 3 Months Salary Slips

- Latest Networth Certificate

- Latest Demat Holding Statement

To expedite the account opening process, you can simply click on ‘I will provide later’ and move on to the next step.

Your demat account will open in the cash segment.

However, you can activate FnO later.

Additional Steps for Non-KRA Users Only- If you haven’t done your KRA KYC Validation, click here↓

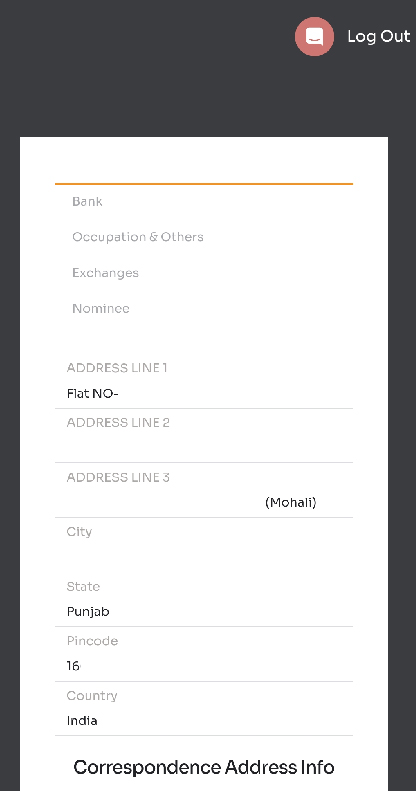

Address Proof: With the help of digilocker, your address will automatically be fetched.

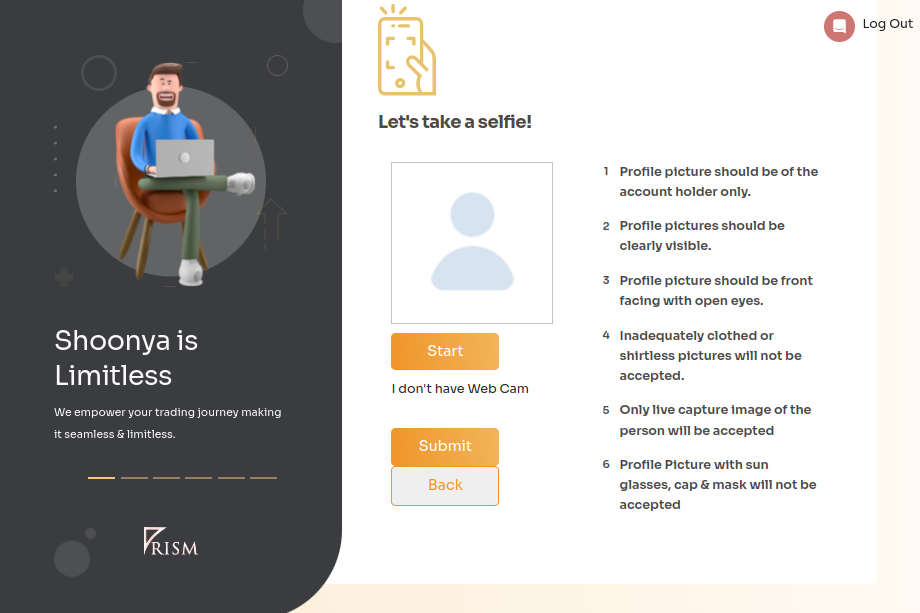

8. Photo verification: Next, as the last step to confirm your identity for opening a demat account online, you must take a selfie and click on ‘submit’.

9. E-Sign Your KYC Document: Let’s e-sign your KYC document to complete your account registration process.

Home » Tutorials » Demat Account » A Step-by-Step Guide on How to Open a Demat Account

10. Confirmation: Once everything’s processed, you’ll get a message confirming your demat account opening process is complete.

Home » Tutorials » Demat Account » A Step-by-Step Guide on How to Open a Demat Account

Keep an eye on your email for your trading login info.

And that’s it! You’re all set up with your Shoonya trading and demat account.

In this process of ‘how to open a demat account’, you’ll need to provide your email address and mobile number.

Additionally, you’ll need a few documents handy:

- PAN Card: Make sure you’ve got your PAN card number and your date of birth handy. Enter these details as they appear on your PAN card.

- Aadhar Card Linked to Mobile Number: Your Aadhar card will be used for verification purposes. It’s crucial that it’s linked to your mobile number.

- Bank Account Details: Have your bank account information ready, including your account number, IFSC code, and branch details.

If you’re interested in trading in the FNO or derivative segment, you’ll also need:

- Income Proof: This could be the latest 6-month bank statement or your latest Income Tax Return (ITR).

- Signature: You can draw your signature on the screen, or you can upload a picture of your signature on plain paper.

How to Open Various Types of Demat Accounts Offline: Steps and Instructions

Below are the steps to open demat account offline:

- Determine the type of account you want to open (non-individual, minor, NRI, or joint account)

- You can download the KYC form from our website (https://shoonya.com/download), or send a request to [email protected].

- Once we get the request, you will receive KYC Forms & list of required documents for the demat account from Shoonya.

- Next, please print out the forms, fill them, and sign them.

You need to send the filled and signed forms to Finvasia Center at the address:

Finvasia Center, Plot no. D-179, Industrial Area, Sector 74, Sahibzada Ajit Singh Nagar, Punjab 160055.

Note: Offline account opening is only available for HUF, minor, corporate, LLP, partnership, and joint accounts.

How to Open Demat Account in India| Know the Documents Required

Here is the list of documents required for opening a demat account:

• Proof of Identity (POI): You need to submit a valid photo identity proof, such as an Aadhaar card or PAN card.

• Proof of Address (POA): You need to submit a valid address proof, such as an Aadhaar card.

• Proof of Income: You must submit proof of income if you want to trade in derivatives, such as futures and options.

You can submit one of these: the latest 6 monthly bank Statements, the latest ITR, the latest Form 16, the latest 3 months’ salary slips, the latest net-worth certificate, or the latest Demat holding statement.

• PAN Card: You must submit a copy of your PAN card, which is mandatory for opening a demat account online.

How to Open Demat Account in India| Things to Remember

Some of the things to keep in mind while opening a demat account online are:

- Type of Demat Account: You need to choose the type of demat account that suits your trading needs and preferences.

There are different types of demat accounts, including:

- Online: Resident Individual

- Offline: NRI demat account, HUF demat account, minor demat account, corporate account, LLP account, Partnership demat account, Joint account

2. Brokerage Fees: Check out the fees and charges for every trade.

With Shoonya, you can open a free demat account in India.

With this, you also enjoy zero AMC. Additionally, there are zero brokerage charges on various segments, including mutual funds, bonds, IPOs, etc.

3. Trading platforms: Check if the broker offers a trading platform with the features you need.

4. Customer service: Look for brokers known for providing timely and helpful customer service.

5. Reputation: You must research the broker’s background and reputation, including customer reviews.

6. Security: Ensure the broker has a secure trading platform to protect your funds and personal information.

7. Customisation and Features: Choose an online trading platform or a DP that lets you customise trades.

Enjoy AI-powered stock market predictions and signals on Shoonya. Use advanced tools on our online trading platform.

Choosing the Right Depository Participant| Why is it Important?

For investors, picking the right depository participant (DP) is crucial. It greatly affects how you trade and the results of your investments.

Here’s why you should think about different things when picking a DP:

- Some DPs charge less or have fixed prices, which can be cheaper if you trade often.

- Choosing a DP with low or no yearly charges can cut down your overall investment expenses.

- A DP’s services, like online trading platforms and customer support, can improve your trading. Make sure the DP offers services that match what you need for your investments.

- Leverage lets you trade more than what’s in your account. While it can boost potential gains, it also brings higher risks.

- Pick a DP that offers leverage that fits your risk tolerance.

Remember, the right DP can be a helpful partner in your investment journey.

Protect Your Demat Account in the Digital Age

In today’s digital investing world, keeping your Demat account safe is super important. You must always look for an online trading platform that uses strong security like tough encryption and two-factor authentication.

Protect your login details, change passwords regularly, and monitor your account statements.

Remember, your Demat account’s security is the key to protecting your money.

FAQs| How to Open Demat Account| Shoonya

To open Demat account for beginners, you must download the Shoonya app or visit PRISM. Enter your details, verify your OTP, and provide your PAN, Aadhar, bank account, and personal details. In a few steps, you will be set to enjoy commission-free investments on multiple segments.

You don’t need to pay anything to open Demat account online. Shoonya offers a free demat account and zero brokerage trading charges on various segments.

Shoonya offers a free Demat account with zero AMC and commission-free trading on various segments, including delivery trades, bonds, mutual funds, etc.

NRIs can open Demat account with Shoonya by providing necessary documents such as PAN, Aadhar, and proof of foreign address (Driving License, Electricity Bill, Water Bill, Tenant Agreement).

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.