Have you ever wondered how some people seem to have a knack for picking the best mutual funds in the market? How do they know which fund house to trust, which fund manager to follow, and which fund scheme to invest in? Do they have some secret formula or insider information that you don’t? Well, the truth is, there is no one-size-fits-all solution when it comes to mutual funds investment. However, there is one factor that can make a big difference in your investment decisions: the asset management companies in India (AMCs). But how do you choose the best AMC for your investment needs? How do you compare and evaluate the performance and reputation of different AMCs? And how do you find out which are the top AMCs in India?

That’s what this blog post is all about.

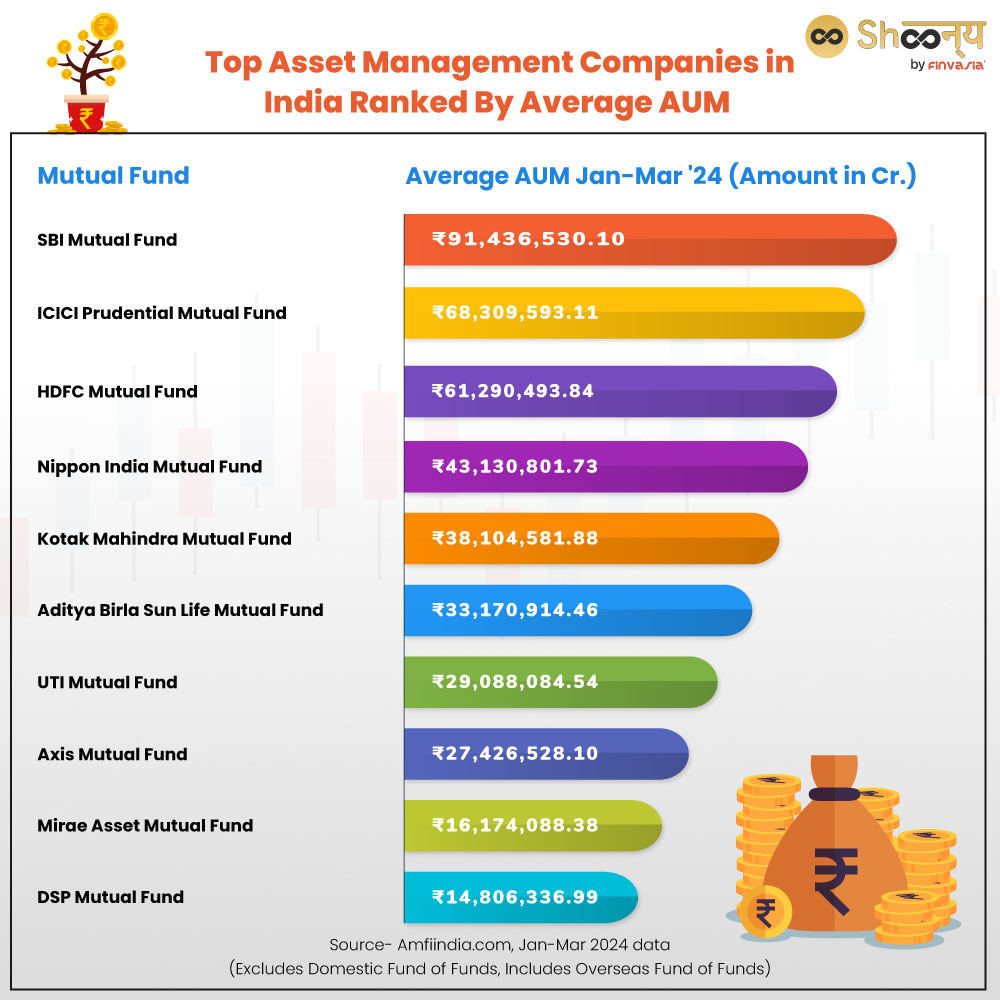

We have created a list of the top 10 Asset Management Companies (AMCs) in India based on their AUM and performance as per the data released by AMFI India for January – March 2024.

- What is an AMC?

- What is AUM?

- How are the Companies Ranked on the Basis of AUM?

- Top Asset Management Companies in India 2024 Ranked By Average AUM

- Overview of the Top 10 Asset Management Companies in India 2024

- SBI Mutual Fund| No. 1 Top AMC in India

- ICICI Prudential Mutual Fund| No 2 Top AMC in India

- HDFC Mutual Fund| No 3 Top AMC in India

- Nippon India Mutual Fund| No 4 Top AMC in India

- Kotak Mahindra Mutual Fund| No. 5 Top AMC in India

- Aditya Birla Sun Life AMC Limited (ABSLAMC)| No. 6 Top AMC in India

- UTI AMC| No 7 Top AMC in India

- Axis Mutual Fund| No 8 Top AMC in India

- Mirae Asset Global Investments| No 9 Top AMC in India

- DSP Mutual Fund| No 10 Top AMC in India

- Process of Creating and Managing Investment Portfolios by AMCs

- Regulatory Roles in Indian Asset Management Companies (AMCs)

- Revised Code of Conduct for Mutual Fund Intermediaries

- AMC Reliability vs. Banks

- Key Considerations for Choosing an Asset Management Company (AMC) in India

- New AMCs in India

- Invest Wisely: Utilize Tools for Informed Mutual Fund Decisions

- FAQs | AMC- Asset Management Companies in India

What is an AMC?

An AMC (asset management company) is an organisation that invests pooled funds from clients into various assets. These could be stocks, bonds, real estate, etc. The AMC charges a fee for managing the funds and aims to generate returns for the investors.

Think of it like this:

Imagine you have a bunch of money you want to invest, but you’re not sure where to put it. That’s where an AMC comes in.

Investment Management Companies helps you invest your money smartly. They have experts who decide which stocks or bonds to buy with your money. So, when you buy shares in an AMC, you’re essentially giving them your money to manage and invest for you. It’s like having a team of financial experts working for you to make your money grow.

Asset management companies in India are also known as fund houses, money managers, or investment companies. There are many AMCs in India that offer different types of mutual funds for various investment objectives and risk profiles.

The investment management companies handle their clients’ money. They pick the best investments, from fast-growing, risky stocks to safe but slow-growing bonds, to help their clients get the returns they need while staying within their comfort zone for risk.

Now comes the most important part- AUM!

AUM (Assets Under Management) is the total value of investments managed by an AMC (Asset Management Company).

What is AUM?

AUM- assets under management, is the total market value of all the assets that an AMC or a mutual fund manages on behalf of its investors.

AUM reflects the size and scale of the fund. It acts as a measure of its success in attracting and retaining investors. AUM also impacts the fund’s performance, investment decisions, and expense ratio. AUM can change daily due to market fluctuations and fund inflows and outflows. Companies are usually ranked on the basis of their AUM to compare their size and performance in the industry.

Indian Mutual Fund Industry’s Growth in AUM

In March 2024, the Average Assets Under Management (AAUM) of the Indian Mutual Fund Industry reached ₹55,00,728 crore.

As of March 31, 2024, the Assets Under Management (AUM) stood at ₹53,40,195 crore.

Over the past decade, the AUM of the Indian Mutual Fund Industry surged from ₹8.25 trillion in March 2014 to ₹53.40 trillion in March 2024, marking a more than 6-fold increase.

From March 2019 to March 2024, the AUM grew from ₹23.80 trillion to ₹53.40 trillion, indicating a more than 2-fold increase in just 5 years.

The industry reached significant milestones with its AUM crossing ₹10 trillion in May 2014, ₹20 trillion in August 2017, and ₹30 trillion in November 2020. As of March 31, 2024, the AUM stood at ₹53.40 trillion.

How are the Companies Ranked on the Basis of AUM?

Companies are usually ranked on the basis of their AUM to compare their size and performance in the industry.

A higher AUM generally indicates that a company is well-established and has the resources to make larger investments.

However, AUM is not the only factor to consider when evaluating a company, as other aspects such as returns, fees, risk, and reputation are also important.

Top Asset Management Companies in India 2024 Ranked By Average AUM

| Mutual Fund | Average AUM Jan-Mar ’24 (Amount in Cr.) |

| SBI Mutual Fund | ₹91,436,530.10 |

| ICICI Prudential Mutual Fund | ₹68,309,593.11 |

| HDFC Mutual Fund | ₹61,290,493.84 |

| Nippon India Mutual Fund | ₹43,130,801.73 |

| Kotak Mahindra Mutual Fund | ₹38,104,581.88 |

| Aditya Birla Sun Life Mutual Fund | ₹33,170,914.46 |

| UTI Mutual Fund | ₹29,088,084.54 |

| Axis Mutual Fund | ₹27,426,528.10 |

| Mirae Asset Mutual Fund | ₹16,174,088.38 |

| DSP Mutual Fund | ₹14,806,336.99 |

Source- Amfiindia.com, Jan-Mar 2024 data (Excludes Domestic Fund of Funds, Includes Overseas Fund of Funds)

As per the data released by amfiindia.com, the top asset management companies in India include

- SBI Mutual Fund – ₹91,436,530.10

- ICICI Prudential Mutual Fund – ₹68,309,593.11

- HDFC Mutual Fund – ₹61,290,493.84

- Nippon India Mutual Fund – ₹43,130,801.73

- Kotak Mahindra Mutual Fund – ₹38,104,581.88

- Aditya Birla Sun Life Mutual Fund – ₹33,170,914.46

- UTI Mutual Fund – ₹29,088,084.54

- Axis Mutual Fund – ₹27,426,528.10

- Mirae Asset Mutual Fund – ₹16,174,088.38

- DSP Mutual Fund – ₹14,806,336.99

These top Asset Management Companies in India have been ranked on the basis of the Average AUM for the quarter of January – March 2024 (Rs in Cr)

Overview of the Top 10 Asset Management Companies in India 2024

The top AMCs in India include:

SBI Mutual Fund| No. 1 Top AMC in India

With a wealth of 36 years of experience in fund management, SBI Funds Management Ltd. (SBIFML), showcases proficiency by consistently delivering value to its investors. Its proud heritage connects us to the State Bank of India (SBI), the largest bank in India.

SBI Mutual Fund is the top AMC in India.

Proudly connected to the State Bank of India (SBI), the largest bank in India.

- SBI Mutual Fund, India’s leading AMC, is a collaboration between the State Bank of India and Amundi, a prominent European asset management company.

- Crafting innovative products and providing investor education are key focuses.

- Active management spans domestic and offshore mutual funds, Alternate Investment Funds, and portfolio management advisory services.

- SBI Mutual Fund maintains its position as the top AMC in India through its diverse offerings and commitment to excellence.

ICICI Prudential Mutual Fund| No 2 Top AMC in India

ICICI Prudential Mutual Fund, with over 25 years of experience, ranks second among the top 10 asset management companies in India.

- ICICI Prudential provides multiple investment solutions across equity, debt, hybrid, and other asset classes.

- Its customer-centric approach and strong research team aim to create long-term wealth for investors.

- With over 120 mutual fund schemes, it caters to different goals and risk appetites.

- Popular schemes include ICICI Prudential Balanced Advantage Fund, ICICI Prudential Bluechip Fund, ICICI Prudential Value Discovery Fund, and ICICI Prudential Corporate Bond Fund.

HDFC Mutual Fund| No 3 Top AMC in India

HDFC Mutual Fund, a subsidiary of HDFC Ltd (India’s leading housing finance company) and Standard Life Investments (a global investment company), ranks as the 3rd among the list of top asset management companies in India, according to the latest AMFI India data.

- Formed in 2001, it’s a joint venture between HDFC Limited and Investment Management Limited (formerly known as Standard Life Investments Limited).

- With a network spanning 200 cities, HDFC AMC operates through 228 branches.

Nippon India Mutual Fund| No 4 Top AMC in India

Nippon India Mutual Fund (NIMF), ranks fourth on the list of top 10 asset management companies in India.

It is one of India’s leading mutual funds, managing Average Assets Under Management (AAUM) of Rs 3,50,564 Crores as of Jul 2023 to Sep 2023 QAAUM.

As of 30th Sep 2023, NIMF has 213.29 Lakhs folios and a presence in 265 locations across the country.

Kotak Mahindra Mutual Fund| No. 5 Top AMC in India

Established in 1985 by Mr. Uday Kotak, Kotak Mahindra Mutual Fund was the first Indian non-banking financial company to be given a banking license in February 2003.

It caters to the financial needs of individuals and institutional investors globally, with a market cap of ₹3,668.4 Bn and a net worth of ₹165.00 Bn.

Aditya Birla Sun Life AMC Limited (ABSLAMC)| No. 6 Top AMC in India

ABSLAMC, incorporated in 1994, is the investment manager of Aditya Birla Sun Life Mutual Fund. Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. are the promoters and major shareholders of this AMC.

- Servicing approximately 8.59 million investor folios across 290 plus locations with an AUM of Rs. 3,458 billion as of March 31, 2024.

- ABCL’s subsidiaries and joint ventures have a nationwide reach with over 1,462 branches and more than 2,00,000 agents/channel partners.

UTI AMC| No 7 Top AMC in India

UTI AMC ranks as the eight biggest asset management company in India with a Total Asset Under Management of INR ₹29,088,084.54 lakh crore as of March 31, 2024.

In 2023, this Asset management company completed 20 years as UTI Asset Management Company Limited. Also, entered 60th year of establishment as Unit Trust of India.

UTI AMC has a nationwide network comprising 190+ UTI Financial Centres.

Axis Mutual Fund| No 8 Top AMC in India

Axis Mutual Fund, launched in October 2009, has grown strongly with a product suite comprising more than 67 schemes.

Axis Mutual Fund Asset Management Company has over 1.26 Crore active investor accounts and a presence in over 100 cities.

It emphasises risk management and encourages investors to take a holistic view, aligning investments with their underlying dreams, aspirations, or goals.

Mirae Asset Global Investments| No 9 Top AMC in India

Mirae Asset Global Investments is a diversified wealth management company with a presence in 14 countries.

The company provides innovative solutions worldwide, adapting to clients’ changing needs and delivering innovative solutions across asset classes.

DSP Mutual Fund| No 10 Top AMC in India

DSP Mutual Fund has been aiding investors for over 25 years in making prudent investment choices responsibly. Thus, making it one of the largest AMCs in India.

Supported by the DSP Group, a venerable Indian financial institution with a legacy spanning nearly 160 years, DSP Mutual Fund has played a pivotal role in the asset management sector in India.

Process of Creating and Managing Investment Portfolios by AMCs

Asset Management Companies (AMCs) pivotally manage investment portfolios in the financial sector to meet investors’ specific financial goals.

Here’s a detailed overview of how top Asset Management Companies manage portfolios:

- Asset Allocation

AMCs strategically allocate assets, balancing risk and reward according to investor objectives. This involves:

• Diversifying investments across various asset classes to mitigate risk.

• Rebalancing the portfolio to maintain the desired asset allocation over time.

- Selection of Securities

Following asset allocation, AMCs select specific securities within each asset class guided by:

• Conducting market trend, economic condition, and financial instrument analyses.

• Evaluating potential securities based on their risk-return profile, ensuring alignment with fund objectives.

• Diversifying holdings within asset classes to spread risk across various sectors and issuers.

- Continuous Performance Evaluation

AMCs continuously monitor and evaluate portfolio performance to ensure alignment with investment goals. This includes:

• Benchmarking portfolio performance against relevant benchmarks.

• Assessing returns relative to the risk taken using metrics like the Sharpe ratio.

• Making tactical adjustments to the portfolio in response to market changes or shifts in investor goals.

Regulatory Roles in Indian Asset Management Companies (AMCs)

SEBI oversees securities and capital markets, ensuring AMCs operate transparently and ethically to safeguard investor interests and market development.

MFI, a self-regulatory organisation, promotes growth, development, and investor protection in the mutual fund industry.

It collaborates with SEBI and RBI on policies and sets operational guidelines for AMCs.

RBI also oversees certain aspects of AMCs, such as approving guaranteed schemes.

Guidelines Laid by SEBI, AMFI, and RBI for Asset Management Companies in India

AMC disclosures must include investment values and percentages of AUM, enhancing transparency in the mutual fund industry.

This regulatory change aims to protect investors’ interests and promote fair practices in the securities market.

Revised Code of Conduct for Mutual Fund Intermediaries

As per the latest guidelines, asset management companies in India must abide by the following:

- Ensure investor interests at all times.

- Asset management companies must follow SEBI Mutual Fund Regulations and guidelines.

- An asset management company must provide full and accurate information about schemes, including risks and commissions, and avoid misrepresentation.

- They must abstain from fraudulent practices and maintain confidentiality.

- Adhere to KYC norms, obtain necessary certifications, and cooperate with regulatory authorities.

AMC Reliability vs. Banks

When comparing Asset Management Companies (AMCs) and traditional banking investments, consider:

- Regulatory Oversight

- SEBI regulates AMCs, while banks are overseen by central banks like RBI.

- AMCs offer diverse investment funds with the potential for higher returns compared to bank investments like savings accounts or fixed deposits. However, the risk element is high in AMC.

- Reliability and Safety

- Investments through mutual funds, have market risks. On the other hand, bank investments, such as fixed deposits, are generally considered safer.

- Investment Approach

AMCs provide professional fund management and diversification across asset classes. Banks offer simpler, low-risk investment products appealing to conservative investors.

Key Considerations for Choosing an Asset Management Company (AMC) in India

To choose the right among the top Asset Management Companies in India, consider these factors:

- Assess AMC’s historical performance across market cycles.

- Look at the Asset Under Management (AUM) to gauge investor trust and handling capacity.

- Understand the AMC’s investment philosophy and how it aligns with your goals.

- Evaluate the expertise of the fund manager, considering experience and track record.

- Examine the cost structure, including expense ratios and fees, for better net gains.

- Confirm the AMC offers diverse funds matching your investment objectives.

- Ensure reliable customer service and regulatory compliance.

- Check the brand reputation and research team capabilities.

New AMCs in India

New and emerging Asset Management Companies in India (AMCs) are reshaping the Indian asset management industry with fresh perspectives and innovative strategies.

Here’s a glimpse of some recent entrants:

- White Oak Mutual Fund focuses on long-term value and sustainable strategies.

- Bajaj Finserv Mutual Fund leverages its strong brand presence.

- Helios Mutual Fund aims for specialised investment strategies.

- Shriram Mutual Funds brings vast financial services experience.

Digital innovation and transformation are revolutionising the Indian asset management industry. These new Asset Management Companies in India(AMCs) bring fresh perspectives, innovative investment strategies, and competitive offerings.

Invest Wisely: Utilize Tools for Informed Mutual Fund Decisions

Investors must conduct thorough research and use tools like SIP Calculators before investing in mutual funds. This ensures the right decisions, helping them understand potential returns and risks associated with their investments. Taking such proactive steps empowers investors to make confident and beneficial financial choices.

FAQs | AMC- Asset Management Companies in India

SBI Mutual Fund, with 36 years of experience, is the biggest asset management company in India, as per the data released by AMFI India for the quarter ended Jan- March, 2024.

As of November 2023, there are 44 investment companies in India, according to the Association of Mutual Funds in India (AMFI).

An asset management company (AMC) is a company that handles money for people. They invest this money in stocks and bonds to make more money. People call them fund houses, money managers, or investment companies.

Source- amfiindia.comExplore the Top 10 AMCs- Asset Management Companies in IndiaExplore the Top 10 AMCs- Asset Management Companies in India

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.