Here, we bring you the list of the 10 best credit cards in India for every need – from fuel savings to shopping rewards. Let’s find you the best credit card for your personal needs!

Credit cards have become one of the most convenient and rewarding ways to pay today. With options like Google Pay, debit cards, and credit cards, India is moving towards a cashless society. Many of us want to save more without making big changes to our spending habits. That is why finding the best credit card has become an important task for almost everyone. Whether it’s for movies, fuel, trips or occasional online shopping, the benefits of credit cards are plenty.

But with so many choices, how do you pick the best credit card for your needs? Which exactly is the best credit card for online shopping? Or which credit card company is the most reliable?

In this post, we’ve listed the top 10 credit cards in India, each offering great features like cashback, fuel discounts, and rewards on bill payments.

Why This List is Helpful

Our curated list of the best credit cards in India in 2024 makes it easy to compare and choose:

- The best credit cards for salaried individuals,

- The best credit cards for online shopping, and

- The best credit cards for students.

Read on to find the best credit card that best matches your spending style!

Let us begin!

- Best Credit Cards in India: Based on RBI’s September 2024 Bank Data

- Best Credit Cards in India 2024: Features and USPs

- HDFC Bank Pvt Ltd: Best Credit Card Company in India

- STATE BANK OF INDIA- SBI: Best Credit Cards in India

- ICICI: Best Credit Card in India for Salaried Persons

- Axis Bank Ltd: Best Credit Cards in India

- Kotak Mahindra Bank Ltd: Best Credit Card For Students

- RBL Bank: Exclusive Credit Cards in India

- IndusInd Bank: Top Credit Cards in India

- IDFC First Bank: Best Credit Cards for Students

- Bank of Baroda: Best Credit Cards in India

- YES Bank: Best Credit Cards

- Which are the Best Credit Cards for Students in India

- Best Credit Card for Online Shopping in India

- How to Choose the Best Credit Card in India

- FAQs: Best Credit Cards for Salaried Persons and Students

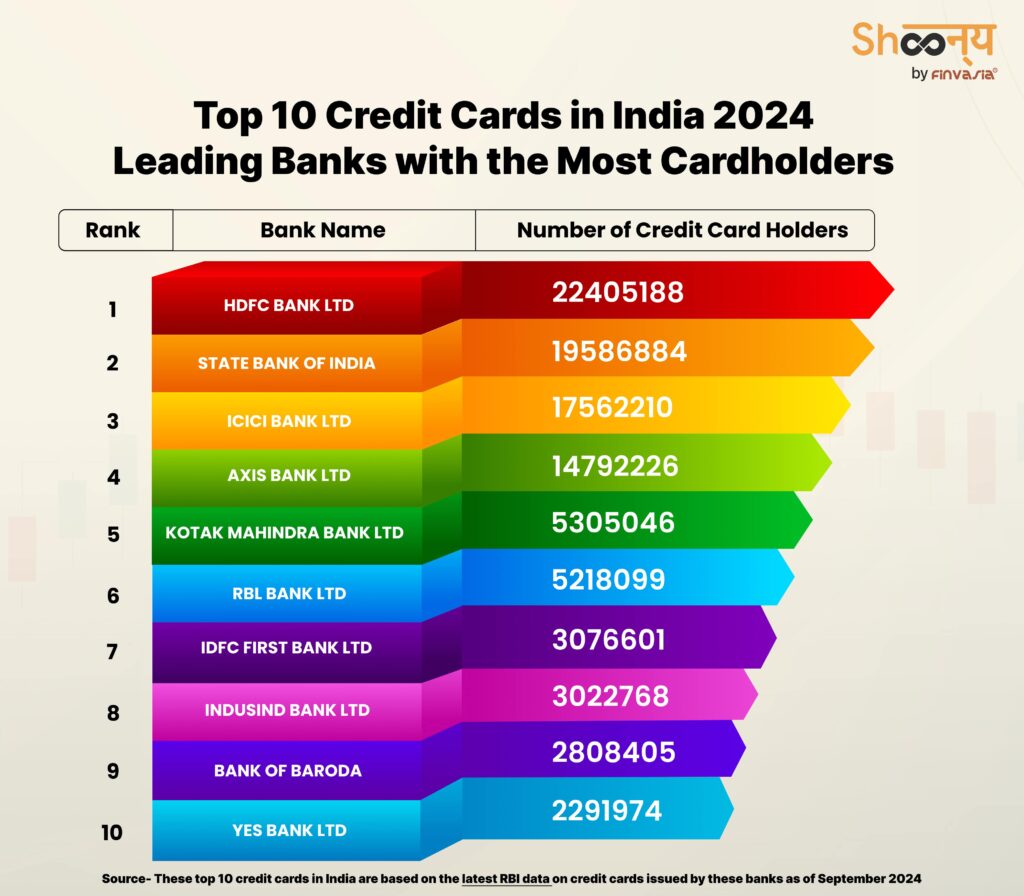

Best Credit Cards in India: Based on RBI’s September 2024 Bank Data

We have created this list of the best credit cards in India based on the latest RBI data on the number of credit cards issued/held by these banks as of September 2024.

| Rank | Bank Name | Credit Cards | Type |

| 1 | HDFC BANK LTD | 22405188 | Private |

| 2 | STATE BANK OF INDIA | 19586884 | Public |

| 3 | ICICI BANK LTD | 17562210 | Private |

| 4 | AXIS BANK LTD | 14792226 | Private |

| 5 | KOTAK MAHINDRA BANK LTD | 5305046 | Private |

| 6 | RBL BANK LTD | 5218099 | Private |

| 7 | IDFC FIRST BANK LTD | 3076601 | Private |

| 8 | INDUSIND BANK LTD | 3022768 | Private |

| 9 | BANK OF BARODA | 2808405 | Public |

| 10 | YES BANK LTD | 2291974 | Private |

Best Credit Cards in India 2024: Features and USPs

Let us understand the key features of these best credit cards in India offered by public and private banks.

HDFC Bank Pvt Ltd: Best Credit Card Company in India

As per the list shared by RBI, on the basis of the maximum number of credit card holders, HDFC stands at the top. There is no doubt why it is one of the best credit cards in India, offering options for travelling, shopping, and more.

When you sign up for an HDFC Bank Credit Card, you get special benefits as a new cardholder. If you shop abroad, selected HDFC Bank Credit Cards offer competitive foreign currency rates.

HDFC Bank offers the best credit card in India for salaried persons.

- Millennia Credit Card

This is one of the best credit cards for students in India. It offers 5% cashback on Amazon, BookMyShow, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato.

What’s more?

You can get ₹1,000 worth of gift vouchers for spending ₹1,00,000 or more each quarter.

- Paytm HDFC Bank Digital Credit Card

This card gives up to 2% accelerated cashback on Scan & Pay. You get up to 2% cashback on Swiggy, and Uber spends

- MoneyBack Credit Card

This card gives you two reward points for every ₹150 spent. You get 2x reward points for shopping online.

STATE BANK OF INDIA- SBI: Best Credit Cards in India

Second on the list of the best credit cards in India, SBI offers some unique credit cards.

- SBI Card ELITE

When you join, you get a welcome e-gift voucher worth Rs. 5,000. You also get free movie tickets worth Rs. 6,000 every year.

- SBI Card PULSE

When you join, you earn 5X reward points for spending at chemists, pharmacies, dining, and movies. Receive an e-voucher worth Rs. 1,500 by spending Rs. 4 lakh in one year.

- Doctor’s SBI Card (in association with IMA)

This card offers a professional indemnity insurance cover of Rs. 20 lakhs. You get an e-gift voucher worth Rs. 1,500 when you join.

SBI Card ELITE Advantage

This card offers a welcome e-gift voucher worth Rs. 5,000 when you join. You also get free movie tickets worth Rs. 6,000 each year.

ICICI: Best Credit Card in India for Salaried Persons

Let’s discover some of the best credit cards in India offered by ICICI Bank.

- Platinum Credit Card

There are no joining or annual fees. You will earn two reward points per Rs. 100 spent, except on fuel.

- Coral Credit Card

You can get a 25% discount on movie tickets twice a month on BookMyShow and Inox. You also receive one complimentary railway and domestic airport lounge access per quarter.

Axis Bank Ltd: Best Credit Cards in India

Axis Bank has one of the top 10 credit cards in India. It has the best credit cards for different needs like shopping, movies, lifestyle, and travel.

Here are some popular credit cards for salaried individuals:

Flipkart Axis Bank Credit Card

- Great for shopping.

- Offers Rs 600 as welcome benefits.

- Has a joining and annual fee of Rs 500 each.

Neo Credit Card

- No joining and annual fee (limited offer on selected channels).

Indian Oil Axis Bank Credit Card

- Get up to Rs 250 cashback on fuel spending.

- Has a joining and annual fee of Rs 500 each.

Kotak Mahindra Bank Ltd: Best Credit Card For Students

Here are some of the best credit cards from Kotak Mahindra:

- Myntra Kotak Credit Card

You must pay INR 500 as a membership fee and annual fee. The benefits of credit card include a 7.5% instant discount on Myntra. Earn 5% cashback on Swiggy, Swiggy Instamart, PVR, Cleartrip, and Urban Company.

- PVR INOX Kotak Credit Card

Ranked one of the best credit cards in India, this one charges no joining fee and INR 499 annual fee. You can also get one free movie ticket for every INR 10,000 spent.

- Kotak UPI RuPay Credit Card

There is no joining fee or annual fee. It’s a virtual lifetime free credit card.

Kotak 811 #DreamDifferent Credit Card is the best credit card for students.

RBL Bank: Exclusive Credit Cards in India

RBL Bank offers over 25 credit cards across categories like cashback, entertainment, rapid rewards, and travel/lifestyle.

The IndianOil RBL Bank XTRA Credit Card is a great choice for those who frequently fuel up at IOCL stations.

- You can earn up to 8.5% savings on IOCL fuel spending and get 15 Fuel Points per ₹100 spent on fuel.

- Receive 2 Fuel Points per ₹100 spent on other purchases.

- Get 3,000 welcome Fuel Points when you make your first spend of ₹500 or more within 30 days.

- The annual fee is waived if you spend ₹2.75 lakh annually.

The best credit cards in India by RBL Bank include:

- ShopRite Credit Card: 10% movie discount.

- World Safari Card: 0% markup on foreign transactions.

- Platinum Maxima Plus Credit Card: 10,000 welcome points.

IndusInd Bank: Top Credit Cards in India

Ranked among one of the top credit card companies in India, IndusInd Bank offers various types of credit cards.

- IndusInd Bank Legend Credit Card

- Annual Fee: No fee

- Reward Points: You earn 2 reward points for every ₹100 you spend on weekends. This is great for those who do a lot of weekend shopping!

- IndusInd Platinum Credit Card

- Annual Fee: No fee

- Reward Points: You earn 1.5 reward points for every ₹150 spent. This is perfect for everyday expenses.

- IndusInd Bank Platinum Aura Edge Credit Card

- Annual Fee: No fee

- Reward Points: Earn up to 4 reward points for every ₹100 spent in select categories like dining, shopping, or travel. It’s a good choice if you spend more in these categories.

- Club Vistara IndusInd Bank Explorer Credit Card

- Annual Fee: ₹10,000

- Reward Points: You get up to 8 CV points for every ₹200 spent. This card is ideal for frequent flyers, as you can redeem points for flights and upgrades.

- IndusInd Bank Duo Credit Card

- Annual Fee: No fee

- Reward Points: Earn 1 reward point for every ₹150 spent. It’s a simple card for those who want to earn rewards for their everyday spending.

IDFC First Bank: Best Credit Cards for Students

IDFC First Bank is one of the most favoured top credit card companies in India.

IDFC FIRST WOW Credit Card is the perfect option for students.

- First Wealth Credit Card- Up to 36 Reward Points on online spending, six domestic lounge visits quarterly, Buy 1 Get 1 Free on BookMyShow.

- RESERVE Credit Card- Up to 24 Reward Points, three domestic lounge visits quarterly, 25% off on BookMyShow.

- ELITE Premium Card- Up to 12 Reward Points, 2 domestic lounge visits quarterly, 25% off on BookMyShow.

Bank of Baroda: Best Credit Cards in India

If you are looking to get the best credit card from a public bank, the Bank of Baroda could be the right choice.

| Best Credit Card | Who It’s For | What You Get |

| Eterna Card | High performers who enjoy lifestyle and travel perks. | Unlimited lounge access, BOGO movie tickets, and reward points for lifestyle upgrades, travel, and more. |

| Premier Card | Adventurous travellers who love exploring. | Travel deals, benefits, and a fee waiver to enhance your journeys. |

| HPCL Energie Card | Road trippers and those always on the move. | Up to 80 litres of free fuel, 25% off on movie tickets, and other rewards for an active lifestyle. |

| One BOBCARD | Those who love ease and functionality with a sleek metal card. | Unlimited shopping rewards, airport lounge access, and card management through a dedicated app. |

| IRCTC BOBCARD | Regular train travellers. | Up to 10% savings on train tickets, shopping rewards, and bonus points to make your train journeys more rewarding. |

Each card is designed with unique features for different lifestyles—whether you’re a frequent traveller, a shopper, or someone who just enjoys a premium experience!

YES Bank: Best Credit Cards

The best credit cards in India by YES Bank include:

- Lifetime-Free Credit Card: No annual or joining fees.

- Power of UPI Payments: Use UPI directly with your credit card.

- Accelerated Reward Points: Earn more rewards on UPI and other spending.

- Instant EMI and EMI on Call: Flexible options for transactions starting from INR 1500.

Which are the Best Credit Cards for Students in India

Students in India have several options for credit cards.

| Credit Card | Benefits |

| IDFC FIRST WOW! Credit Card | – Earn 7.5% interest on Fixed Deposit (FD).- Get 4X Reward Points on all credit card transactions.- High credit limit with no joining or annual fees.- Immediate 100% ATM cash withdrawal limit.- The activation bonus of 500 reward points is available after spending Rs. 5,000. |

| ICICI Student Forex Prepaid Card | – Joining benefits worth INR 5,000.- Includes an ISIC membership worth INR 999.- A complimentary international SIM card is required for overseas travel.- Coverage for lost or counterfeit cards with liability protection up to INR 5,00,000. |

| Kotak Mahindra 811 #DreamDifferent Credit Card | – Interest-free cash withdrawals for up to 48 days.- High credit limit up to Rs. 16 lakhs, known upfront at the time of application. |

Best Credit Card for Online Shopping in India

If you are looking for the best credit card for online shopping, you can choose one from the options below.

There are multiple types of cards issued by these best credit card companies in India.

| Bank | Best Credit Cards |

| HDFC Bank Ltd | – HDFC Millennia Credit Card- HDFC Moneyback+ Credit Card- HDFC Diners Club Privilege Credit Card |

| State Bank of India | – Cashback SBI Card- Amazon Pay ICICI Credit Card- SBI SimplyCLICK Credit Card |

| ICICI Bank Ltd | – Amazon Pay ICICI Credit Card- ICICI Bank Sapphiro Credit Card |

| Axis Bank Ltd | – Flipkart Axis Bank Credit Card- Axis Bank ACE Credit Card- Axis Bank Buzz Credit Card |

| Kotak Mahindra Bank Ltd | – Kotak PVR Platinum Credit Card- Kotak Indigo Ka-Ching 6E Rewards Credit Card- Kotak White Credit Card- Kotak Cookies Credit Card |

| RBL Bank Ltd | – ShopRite Credit Card- Icon Credit Card- Platinum Maxima Plus Credit Card |

| YES Bank Ltd | – YES FIRST Preferred Credit Card- YES FIRST Exclusive Credit Card- YES Premia Credit Card- YES Prosperity Edge Credit Card |

This ends our list of top 10 credit cards in India.

However, there’s more to learn before you choose the best credit card in India.

How to Choose the Best Credit Card in India

Here are some of the features you must watch out for before applying for the best credit card in India:

• Credit Score

The higher your credit score, the more likely you will get approved for a credit card and get better offers and rewards.

Check out the five reasons that might be affecting your credit score!

• Annual Fee

Some credit cards have no annual fee, while others may charge a high fee. You should compare the annual fee with the benefits that the credit card offers.

• Credit limit

This is the maximum amount of money that you can borrow from your credit card at any given time. It depends on your income, credit score, and other factors. You should choose a credit card with a credit limit that suits your spending habits and needs.

• Interest Rate

This is the rate of interest that you have to pay on the money that you borrow from your credit card. Some credit cards offer a low or zero interest rate for a certain period of time, such as 6 months or 12 months.

• Rewards

Rewards are the benefits that you get from using your credit card. They can include points, miles, cashback, vouchers, discounts, or other perks. You should choose a credit card that offers rewards that match your preferences and lifestyle.

FAQs: Best Credit Cards for Salaried Persons and Students

Some of the best credit cards in India are from HDFC, SBI, ICICI, and Axis Bank. You can check the list of the top 10 credit cards to choose the one that suits the features you are looking for!

The four common types of credit cards are rewards cards, cashback cards, travel cards, and shopping cards.

HDFC, SBI, ICICI, and Axis Bank offer some of the best credit cards in India.

The best card depends on your spending habits, but HDFC Bank and SBI cards are popular for their rewards and benefits.

The HDFC Infinia Credit Card is often considered one of the top cards due to its high reward points and premium benefits.

SBI Card Elite and HDFC Millennia are popular for salaried individuals, offering great cashback and rewards on everyday purchases.

Cards from HDFC, SBI, Yes Bank and Axis Bank are known for offering great perks on travel, shopping, and dining.

HDFC Bank leads with 22405188 credit cards, topping the list of best credit card companies in India as of 2024.

Credit cards offer rewards like cashback, discounts on shopping, travel benefits, and access to exclusive events and offers.

Source- rbi.org.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.