Foreign investment significantly enriches the Indian economy by bridging the divide between domestic savings and substantial investment requirements. It stands as a pivotal pillar in this regard. India, being among the fastest-growing economies globally, naturally attracts considerable foreign capital. Now, imagine you’re this foreign investor who is eager to enter into the Indian stock market. You’ve got two main avenues to explore: FPI or FII. These terms may sound confusing, but they are actually quite simple to understand. In this blog, we will focus on FPI vs FII, which are two of the most common and popular ways of foreign investment in India.

We’ll explain them, examine the differences between FPI and FII, and discover why they’re important for the Indian stock market.

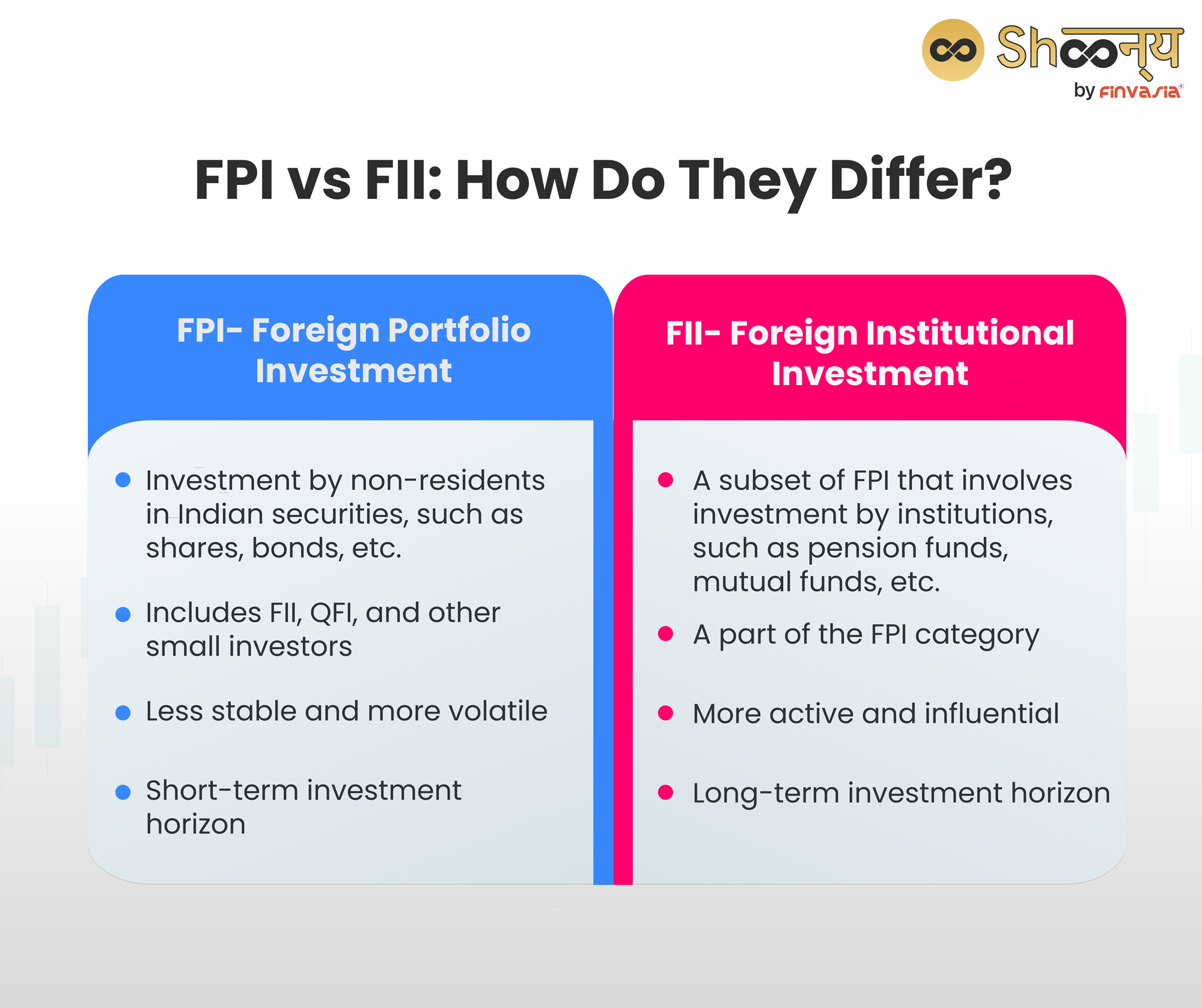

- FPI vs FII: How Do They Differ

- FPI Meaning- Foreign Portfolio Investment

- FII Meaning- Foreign Institutional Investor

- FPI vs FII: Exploring the Key Difference Between FPI and FII

- Why are FPI and FII Important for the Indian stock market?

- Recent Regulatory Developments in Foreign Portfolio Investment (FPI) in India

- Recent Amendments in FDI

- Economic Impact of FDI

- Environmental Impact of FDI

- Key Considerations for Overseas Investments

- Conclusion

- FAQs: FPI vs FII

FPI vs FII: How Do They Differ

Think of FPI, or Foreign Portfolio Investment, as the “mix-it-up” approach for foreign investors in India. It’s like you’re at a financial buffet, throwing your money into a bit of everything – stocks, bonds, and all kinds of money-making goodies.

FPI is basically a variety pack of investments.

On the other hand, FII, or Foreign Institutional Investment, is a bit different. Imagine the big shots – pension funds, insurance companies, mutual funds, etc. – going all-in on a specific dish they really fancy at the investment buffet. In this case, it is the Indian stock market.

It’s like they’ve found their favourite and are putting their money where their appetite is.

So, just to sum it up:

- FPI is like spreading your investment love across the whole menu, enjoying the diversity.

- FII is more like picking a favourite dish and going all out on that one. They know what they want, and they’re diving deep into that part of the market.

The primary difference between FPI and FII lies in their regulatory structures.

FPIs have a more relaxed registration procedure and regulatory supervision. This results in fewer obstacles to entry and exit.

On the other hand, despite being a subset of FPIs, FIIs experience a thorough registration process. They face heightened regulatory scrutiny.

This owes to their typically long-term investment perspective, which can exert a more substantial influence on the markets.

FPI Meaning- Foreign Portfolio Investment

FPI stands for foreign portfolio investment.

It is an investment by non-residents in Indian securities, such as shares, bonds, debentures, and derivatives.

Some Features of FPI Investments

FPI is a passive form of investment.

- Foreign investors lack direct control over Indian company management or operations.

- Investments are typically short—to medium-term. This allows foreign investors to buy or sell securities quickly in response to market fluctuations.

- The lack of direct control enables flexibility in investment strategies. It facilitates quick adjustments based on prevailing market conditions.

The Securities and Exchange Board of India (SEBI) regulates FPIs in India.

Pros of Foreign Portfolio Investments

Investors enjoy several advantages with Foreign Portfolio Investments (FPI).

- Firstly, it offers the opportunity for portfolio diversification on an international level. It helps in spreading investment risks across various assets and markets.

- Additionally, FPI provides access to international credit, offering creditors a broader base for potential growth.

- Another benefit stems from favourable exchange rates. When an investor holds FPI in a country with a stronger currency, the variance in exchange rates can be advantageous.

Cons of Foreign Portfolio Investments

Despite the merits, Foreign Portfolio Investments come with their share of drawbacks.

Unlike Foreign Direct Investments, investors in FPI lack control over the management or operations of the acquired firm or business entity.

Moreover, higher volatility denominates FPIs. This makes its asset prices susceptible to sudden fluctuations in response to adverse shocks.

FII Meaning- Foreign Institutional Investor

FII stands for foreign institutional investor, which is a subset of FPI.

FII refers to investments made by foreign institutional investors in Indian securities. It is a specific type of FPI that involves only institutional investors, not individual or small investors.

FII is also regulated by SEBI, which issues FII registration certificates and monitors their activities and transactions.

SEBI has also prescribed FII investment limits for different types of securities, such as equity, debt, and hybrid.

FPI vs FII: Exploring the Key Difference Between FPI and FII

| FPI- Foreign Portfolio Investment | FII- Foreign Institutional Investment |

| Investment by non-residents in Indian securities, such as shares, bonds, etc. | A subset of FPI that involves investment by institutions, such as pension funds, mutual funds, etc. |

| Includes FII, QFI, and other small investors | A part of the FPI category |

| Less stable and more volatile | More active and influential |

| Short-term investment horizon | Long-term investment horizon |

Here are some of the key differences between FPI and FII:

• FPI is a broader category that includes FII, as well as other smaller and individual investors. FII is a specific type of FPI that involves only institutional investors.

• SEBI introduced FPI in 2014 to simplify and rationalise the foreign investment regime in India. FII is an older term that was used before 2014 to refer to foreign institutional investment in India.

• SEBI classifies FPI into three categories based on the risk profile and KYC compliance of foreign investors. Thus, FII falls under category II alongside regulated entities.

• FPI can invest in a wider range of securities than FII. This includes government securities, corporate bonds, and infrastructure securities. FII can invest only in equity, debt, and hybrid securities.

Why are FPI and FII Important for the Indian stock market?

FPI and FII are important for the Indian stock market, as they have a significant impact on market movements, trends, and sentiments.

Here are some of the reasons why FPI and FII matter for the Indian stock market:

- FPI and FII bring foreign capital into India, which helps boost the country’s economic growth, development, and stability.

- They help to increase the country’s foreign exchange reserves. This helps enhance the external sector balance and the currency stability of the country.

- FPI and FII increase the depth and breadth of the Indian stock market by providing more liquidity, diversity, and competition.

- These influence the stock prices, returns, and valuations of Indian companies.

- They affect the market indices, such as Sensex and Nifty, which reflect the overall performance and direction of the market.

Foreign Portfolio Investment (FPI) Impact on the Indian economy

FPIs hold great relevance for the Indian stock market:

• FPIs inject substantial foreign capital. This capital fuels the growth of Indian companies and government development initiatives.

• FPI presence boosts market liquidity. Thus, facilitating easier buying and selling of securities which is vital for efficient capital market operations.

• FPI inflows can strengthen the local currency by increasing demand for the rupee. Conversely, FPI divestment can trigger rupee depreciation as currency supply rises.

Recent Regulatory Developments in Foreign Portfolio Investment (FPI) in India

Here are some key changes and proposals:

- SEBI has introduced amendments mandating more detailed disclosures to identify the Ultimate Beneficial Owners (UBO) of FPIs.

Changes determine the level of control or influence an investor holds over a company.

- In 2021, SEBI introduced amendments to FPI regulations, allowing FPIs to participate in OFS and invest in unlisted debt securities.

Continuous efforts by SEBI aim to simplify FPI regulations. Thus enhancing flexibility and attractiveness for foreign investors.

Now, besides knowing the difference between FPI and FII, let’s briefly discuss FDI as well.

Foreign Direct Investment (FDI) is a main economic driver in which an individual or business from one country invests in a business in another country.

It’s a key element for international economic integration, fostering global business relations and economic development.

Recent Amendments in FDI

Recent amendments in India’s Foreign Direct Investment (FDI) policies enact significant changes:

• The Union Cabinet approves amendments in the FDI policy on the space sector to realise the vision of an Atmanirbhar Bharat.

The amendments liberalise FDI thresholds for various subsectors/activities within the space sector.

• The Indian government has amended the Foreign Exchange Management Act (FEMA) rules. It now allows up to 20% foreign direct investment (FDI) in the Life Insurance Corporation of India (LIC).

Economic Impact of FDI

Foreign Direct Investment (FDI) significantly drives economic growth, especially in developing countries like India.

It boosts GDP growth, encourages innovation, and creates job opportunities. FDI also helps bridge the gap between investment and savings, leading to more efficient resource allocation.

Unlike Foreign Portfolio Investment (FPI), FDI provides long-term stability and commitment to the host economy.

Investors usually play a more active role in management.

Environmental Impact of FDI

The environmental impact of FDI can have dual aspects. On the one hand, FDI can contribute to environmental degradation.

This is often linked to the ‘pollution haven’ hypothesis, where firms relocate to countries with lenient environmental regulations. On the other hand, FDI can also introduce green technologies and sustainable practices.

Key Considerations for Overseas Investments

Foreign investors consider various factors before making investments in overseas markets. These factors greatly affect their decisions and potential returns.

Here are some important considerations:

• Investors must analyse a country’s overall economic health. This includes GDP growth rates, inflation, unemployment, and consumer spending.

• Political stability, legal framework, and policies related to foreign investment, like tax laws and FDI regulations, must be closely examined.

• The size, growth potential, consumer preferences, and competition in the market influence investment decisions.

Understanding local customs, business practices, and consumer behaviour is crucial to align business strategies with local expectations.

Conclusion

FPI and FII are two of the most common and popular ways of foreign investment in India, which significantly impact the Indian economy and market. FPI and FII bring in foreign capital, increase market liquidity and efficiency, and influence stock prices and returns.

Therefore, investors need to understand the differences and implications of FPI vs FII. Also, you must keep track of trends and movements in the market.

FAQs: FPI vs FII

The main difference between FII and FDI is that foreign institutional investment, involves investing in financial assets like stocks and bonds in a foreign country. FDI, or foreign direct investment, is about gaining control of a foreign business, like creating a subsidiary or a joint venture.

FPI and FDI serve different goals. FPI is more flexible and diversified but also more volatile. FDI is stable, long-term, and influential, but it can be costlier, riskier, and more regulated.

Portfolio investment (PI) covers both domestic and foreign investments in financial assets. FDI is a specific foreign investment type involving substantial control in a foreign business. PI doesn’t aim to influence management, while FDI does.

Source- https://www.hindustantimes.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.